Weekly FX Chartbook: Fed to Start its Rate Cut Cycle

Key points:

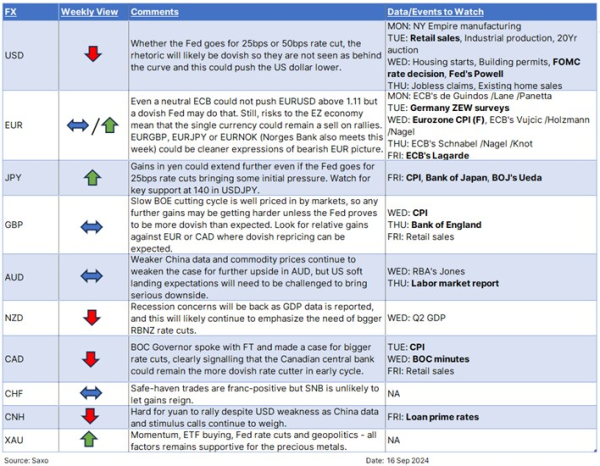

- USD: 25 or 50bps, Fed will be dovish

- JPY: More gains likely on Fed-BOJ divergence and safe-haven demands

- EUR: Sell on rallies amid Eurozone economic headwinds

- GBP: Resilience on test as BOE path is well priced in

- CNH: China’s growth concerns fuelling more stimulus calls

-------------------------------------------------------------------------------------------------------

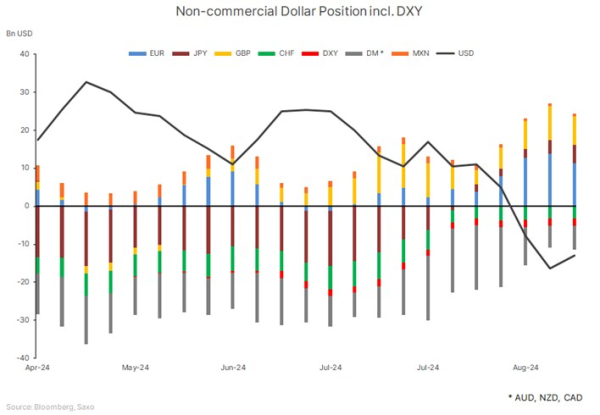

USD: Fed’s Dovish Stance, Dot Plot and Powell on Watch

The debate over the size of the upcoming FOMC rate cut remains undecided, with the market still weighing a 25bps versus a 50bps reduction. While recent data, like August’s stronger-than-expected core CPI, supports a 25bps cut, the narrative has increasingly shifted towards a 50bps move. A recent Wall Street Journal article from Fed whisperer Nick Timiraos and comments by former NY Fed President Bill Dudley have fueled speculation about a more aggressive cut.

If the Fed opts for a 25bps cut, expect dovish rhetoric, potentially setting the stage for a 50bps cut in November or even an inter-meeting adjustment if the labor market weakens significantly. The upcoming labor market data will be crucial as the Fed looks to balance its easing path with maintaining inflation expectations and its data-driven approach.

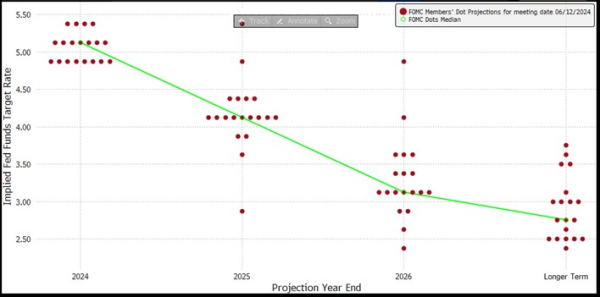

In terms of the dot plot, the 2024 projections are expected to show 2-3 cuts, up from just one in June, signaling a dovish shift. However, the key focus will be on 2025, where a faster pace of cuts could risk signaling recession fears. The Fed is likely to communicate a measured approach to easing, aiming for gradual adjustments to reflect evolving inflation and employment conditions, rather than a rapid, reactive shift.

In market terms, a 25bps cut could initially bring higher US Treasury yields and the USD, but Powell is likely to come out dovish in his press conference. That means any bounce in yields or US dollar is likely to be short-lived, with the broader soft-dollar trend expected to persist, especially if the Fed signals a more aggressive easing trajectory.

JPY: Both Fed and Bank of Japan Decisions This Week

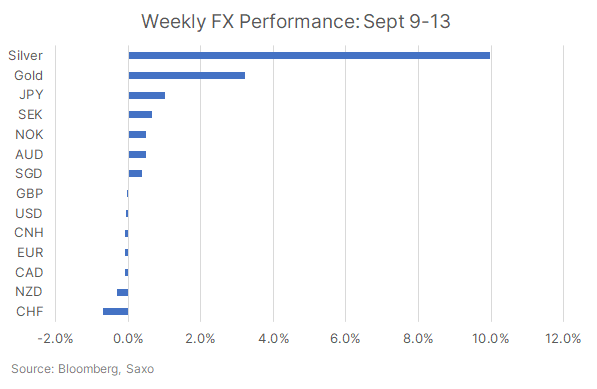

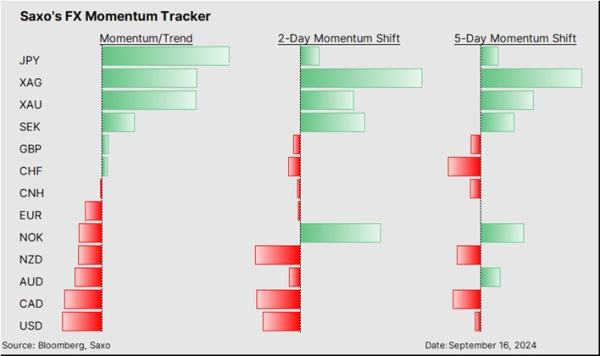

The Japanese yen has strengthened to 140 against the US dollar for the first time since 2003 as markets are increasing the odds of a bigger rate cut from the Fed this week. But it’s not just the prospects of a dovish Fed that is pushing yen higher, but also a mildly hawkish Bank of Japan that announces its policy decision on Friday.

Even though no further policy normalization is expected from the BOJ this week, Governor Ueda is likely to maintain the hawkish tone heard in previous press conferences, with several BOJ members indicating their openness to further rate hikes if the economic outlook remains aligned with expectations. This has been laying the groundwork for rate increases as soon as October.

The yen is also benefitting from lower oil prices and its safe-haven traits that give it an edge to act as a hedge if U.S. equities re-price lower on weaker growth projections. A break below the key 140 level signals potential for further upside for the yen in the near term.

GBP: Outperformance Could Start to Get Selective

The upcoming week will be crucial for the GBP, with key events including UK CPI, retail sales, and the Bank of England meeting. UK swaps are currently pricing in only a 22% chance of a 25bps rate cut from the BoE, reflecting a high bar for any rate change. Consequently, unless CPI data significantly deviates from expectations, major shifts in swap pricing or GBP movement are unlikely.

Although services inflation is expected to rise in August, this is primarily due to base effects in areas that the BoE tends to overlook. The Bank has already indicated that it anticipates a temporary rise in services inflation this autumn before it eases by year-end.

Given the persistently high services inflation, the BoE is proceeding more cautiously compared to the Fed regarding rate cuts, and a policy change this month seems unlikely. The committee is not expected to adopt a more dovish stance just yet.

The BoE is anticipated to maintain the current 5% rate, with the voting split potentially impacting GBP movement. A 6:3 split might suggest more urgency for easing putting pressure on sterling, while an 8:1 split could imply less immediate pressure. With the BOE path also well priced in by markets, GBP may face challenges in making further gains, so it might be more prudent to focus on currency crosses, particularly those offering relative outperformance against the EUR or CAD where dovish repricing remains plausible.

------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------

Recent FX articles:

- 11 Sep: JPY: Upside Fueled by BOJ Hawkishness and Election Volatility

- 4 Sep: JPY: Safe-Haven Appeal on Display, Carry Unwind Risks on the Radar

- 3 Sep: USD at Crossroads: End of Strength or Start of a Crisis?

- 28 Aug: AUD: Short-term Gains, Long-term Risks

- 28 Aug: CAD: Rally at Odds with Fundamentals

- 21 Aug: US Dollar: Excessive Weakness or More to Come?

- 16 Aug: FX Markets Face a Tug-of-War: A Scenario Analysis

- 14 Aug: NZD: Rate Cut Cycle Has Kicked Off

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

Recent Macro articles:

- 12 Sep: US Votes, Asia Reacts: Investment Strategies for a Trump-Harris Showdown

- 5 Sep: Mastering Diversification: A Comprehensive Guide to Balancing Your Investment Portfolio

- 30 Aug: Nvidia's Blackwell Chips: Raising the Bar in Generative AI

- 15 Aug: Warren Buffett’s Portfolio Shifts: New Bets, Big Buys, and Surprising Exits

- 15 Aug: US CPI: Fed Rate Cut Remains in Play, but 25 vs. 50bps Debate Unsettled

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

Weekly FX Chartbooks:

- 9 Sept: Weekly FX Chartbook: Mixed Jobs Data Will Make Fed’s 50bps Cut Harder

- 2 Sept: Weekly FX Chartbook: Labor Data Holds the Key to Size of Fed’s Rate Cut

- 26 Aug: Weekly FX Chartbook: Powell Keeps the Door for 50bps Rate Cut Open

- 19 Aug: Weekly FX Chartbook: Over to Policymakers – Fed’s Powell, Kamala Harris, and BOJ’s Ueda in Focus

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

FX 101 Series:

- 26 Aug: Navigating Portfolio Risks Amid Weakening U.S. Dollar

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar