Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

Key points:

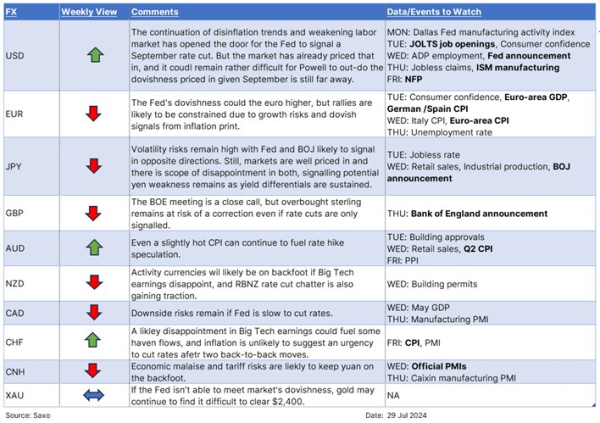

- USD: The Fed may find it hard to meet market’s dovish expectations

- JPY: Volatility risks remain high with Fed-BOJ policy divergence in focus

- GBP: Overbought positioning could be a risk going into close-call BOE meeting

- AUD: Any hints of hot inflation can spur further RBA rate hike bets

- CNH: Economic and tariff risks continue to escalate

-----------------------------------------------------------------------

Recent FX articles and podcasts:

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

- 26 Jun: AUD, CAD: Inflation Rising, Can Central Banks Stay on Pause?

- 21 Jun: JPY: Three-Way Pressure Piling Up

- 20 Jun: CNH: China Authorities Loosening their Grip, But Devaluation Unlikely

- 19 Jun: CHF: Temporary Haven Flows Unlikely to Fuel SNB Rate Cut

- 18 Jun: GBP: UK CPI Details and Elections Will Keep BOE on Hold

- 13 Jun: BOJ Preview: Tapering and Rate Hike Talk Not Enough to Boost JPY

- 10 Jun: EUR: Election jitters and ECB rate cut add to downside pressures

Recent Macro articles and podcasts:

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

- 28 Jun: UK Elections: Markets May Be Too Complacent

- 24 Jun: Macro Podcast: Is it time to diversify your portfolio?

- 12 Jun: France Election Turmoil: European Equities Amidst the Upheaval

- 11 Jun: US CPI and Fed Previews: Delays, but Dovish

- 10 Jun: Macro Podcast: Nonfarm payroll shatters expectations - how will the Fed react?

- 3 Jun: Macro Podcast: It is a rate cut week

Weekly FX Chartbooks:

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: FX 101: USD Smile and portfolio impacts from King Dollar