Weekly FX Chartbook: Over to Policymakers – Fed’s Powell, Kamala Harris, and BOJ’s Ueda in Focus

Key points:

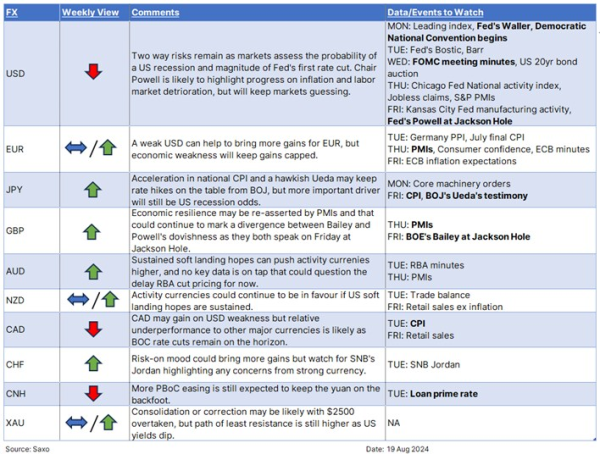

- USD: Two-way risks but Powell on Friday could point towards a Sept rate cut

- JPY: Markets positioning for Powell-Ueda divergence again

- GBP: PMIs could keep economic resilience in focus

- AUD: No data out to question the delay in RBA’s easing

- CNH: More PBoC easing remains likely

------------------------------------------------------------------------------------------------------

USD: Powell Won’t Break Market’s 25 vs. 50 bps Cut Dilemma

The Federal Reserve's Jackson Hole Symposium, scheduled for August 22-24, is highly anticipated as it will provide key insights into the Fed's thinking on the neutral rate and the future path of monetary policy. Chair Jerome Powell's speech on August 23 at 14:00 GMT will likely emphasize the effectiveness of the current restrictive monetary policy in controlling inflation and cooling the US economy. Powell is expected to discuss the Fed's dual mandate, with particular attention to both price stability and full employment.

Fed officials have been hinting at a September rate cut more openly now, and Chair Powell will likely follow suit with his fellow policymakers. However, the focus will also be on whether Powell hints at a potential 50 bps rate cut at the September FOMC meeting. While labor market deterioration led to the markets expecting a bigger rate cut in September, data since has been mixed with upbeat retail sales still signalling a resilient consumer. This could keep Powell wary of sending a strong signal on the magnitude of the first rate cut. Also, any clear risks of a larger rate cut could also signal a policy mistake from the Fed and higher recession risks. Thus, the speech will carefully balance these concerns while leaving future policy decisions open, depending on upcoming data releases. The August jobs report, due on September 6, in essence holds the key to the magnitude of Fed’s rate cut rather than Powell at Jackson Hole.

The bigger focus from Jackson Hole should be on the discussions around neutral rate, the interest rate at which monetary policy neither stimulates nor restrains the economy. This will also bring questions around whether inflation target should be higher, and could be a key input on where the terminal rate could be in the current cycle.

Macro: Can Harris Maintain Momentum?

The Democratic National Convention (DNC) from August 21-24 will be a crucial juncture in the 2024 US Presidential election cycle. With Vice President Kamala Harris now the Democratic nominee, the convention will serve as a pivotal platform for solidifying party unity and setting the stage for the general election campaign.

Anticipated highlights include keynote addresses from prominent figures such as former President Barack Obama, who will likely stress the importance of unity and voter engagement in key battleground states. Harris is expected to showcase her vision for the future, emphasizing the administration's achievements and outlining her plans to address ongoing challenges in healthcare, climate change, and economic inequality.

One of the key moments will be Harris’s acceptance speech, where she is anticipated to present her policy agenda and strategies for countering Republican criticisms. She faces significant challenges, including turmoil in the Middle East, a slowdown in U.S. job growth, and persistent voter concerns about inflation. Additionally, she can expect intensified attacks from the Republican camp and closer scrutiny of her policy proposals. Her speech will be crucial in rallying the base and attracting undecided voters, setting the tone for the campaign's final stretch. Overall, the DNC will aim to energize Democratic supporters and build momentum for the upcoming election, positioning Harris as a strong contender for the presidency.

For the markets, Harris's nomination could signal a shift from the “Trump trade,” which has been characterized by a focus on deregulation, tax cuts, and trade uncertainties. Investors might anticipate greater regulatory oversight and increased focus on social and environmental issues under Harris, influencing sectors like clean energy and healthcare. The Harris trade might involve positioning in industries that benefit from her policy agenda, contrasting with the Trump trade's emphasis on traditional energy and financial deregulation.

JPY: Ueda Could Bring Back Focus on Rate Hikes

On August 23, Bank of Japan (BOJ) Governor Kazuo Ueda will be addressing Japan's parliament in a special session, convened to scrutinize the BOJ's unexpected decision to raise interest rates on July 31. This decision led to significant market volatility, including the biggest stock market drop since 1987 and a sharp rise in the yen, which has raised concerns among lawmakers.

Governor Ueda is expected to defend the BOJ's decision by highlighting Japan's economic data, particularly the weak yen and the rising national core CPI, which reached 2.6% YoY in June, with expectations of further acceleration to 2.7% in July. Ueda will likely argue that the rate hike was a necessary step to manage inflationary pressures and that the BOJ remains committed to its goal of stabilizing prices and ensuring sustainable economic growth. Additionally, Ueda might express confidence that wage increases from the spring labor negotiations are contributing to higher consumer prices, bringing the BOJ closer to its sustainable 2% inflation target.

Additionally, Japan's economy has shown signs of recovery, with real GDP growth rebounding to an annualized 3.1% in Q2 2024, compared to a contraction in the previous quarter. Private consumption growth has also turned positive after four quarters of decline, providing further justification for the BOJ's move.

Despite the market's reaction, the BOJ appears poised to continue its path toward policy normalization, with Ueda signaling that further rate hikes could be on the table if economic conditions remain favorable. However, he may adopt a more balanced tone to avoid a repeat of the recent market turmoil, echoing Deputy Governor Shinichi Uchida's cautious stance. This approach may do little to halt the yen's recent gains, that have been somewhat erased because US soft landing continues to look achievable. If US recession concerns resurface, there is a risk of further unwinding in carry trades, especially if the BOJ continues its trajectory of rate hikes.

-----------------------------------------------------------------------

Recent FX articles and podcasts:

- 16 Aug: FX Markets Face a Tug-of-War: A Scenario Analysis

- 14 Aug: NZD: Rate Cut Cycle Has Kicked Off

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

- 31 Jul: JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

Recent Macro articles and podcasts:

- 15 Aug: Warren Buffett’s Portfolio Shifts: New Bets, Big Buys, and Surprising Exits

- 15 Aug: US CPI: Fed Rate Cut Remains in Play, but 25 vs. 50bps Debate Unsettled

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

Weekly FX Chartbooks:

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar