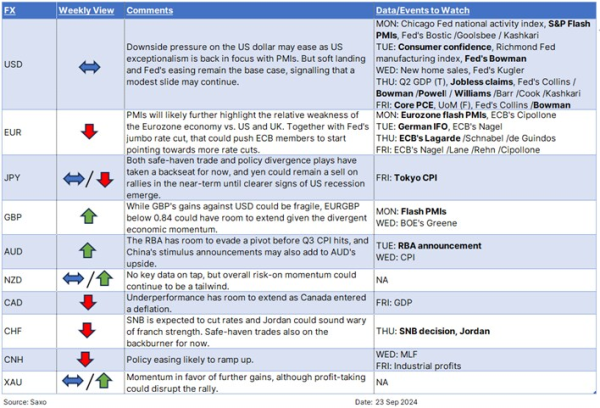

Weekly FX Chartbook: Policy Divergences Remain in the Driving Seat

Key points:

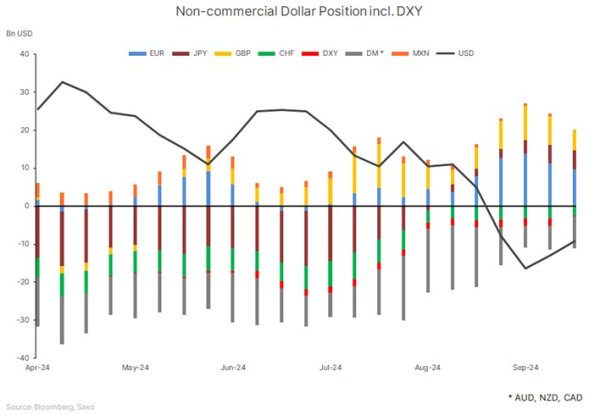

- USD: Fed speakers, including Powell, Williams and the dissenter Bowman on tap

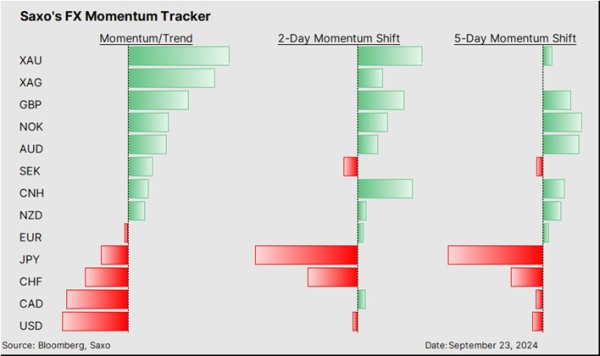

- JPY: Sell on rallies likely as both safe-haven trade and policy divergence theme on the backfoot

- AUD: RBA’s relative hawkishness, soft-landing and China stimulus could paint a bullish picture

- EURGBP: PMI divergence in focus

- CNH: China’s economic weakness and Fed’s jumbo cut provide room to ramp up stimulus

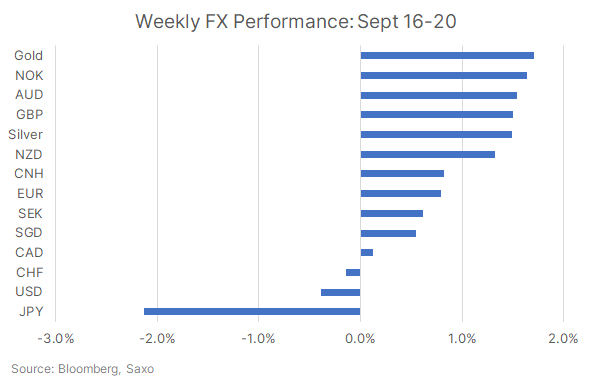

- Gold: Strong momentum, but be wary of profit-taking

-----------------------------------------------------------------------------------------------------------

AUD: RBA Has Room to Stay Hawkish

The Reserve Bank of Australia (RBA) is widely expected to keep rates unchanged at their upcoming meeting, as inflation remains elevated and the case for easing is weak. Although July’s headline inflation figure of 3.5% seems close to the RBA’s target of 2-3%, the decline from 3.8% was mainly due to temporary electricity rebates. Inflation could soon fall into the 2-3% but this does not seem to be coming from underlying demand cooling. Q2 GDP growth also showed weaker-than-trend growth, largely due to softening household consumption, while government spending remained resilient. However, the RBA continued to see the labour market remaining tight, with vacancies, unemployment, and hours worked still at healthy levels.

Despite this, markets continue to price in a rate cut this year, even though the RBA has been pushing back on such expectations. The Fed’s large rate cut has increased speculation that the RBA may be forced to follow suit sooner than anticipated. However, the RBA is likely to stick to its hawkish stance for now, aiming to keep inflation expectations anchored. A potential pivot may come only at the November 5 meeting at the earliest, depending on further labor market data and the Q3 CPI report.

The Australian dollar stands to benefit in the near term from a soft-landing scenario, the RBA’s relative hawkishness, and additional stimulus measures from China.

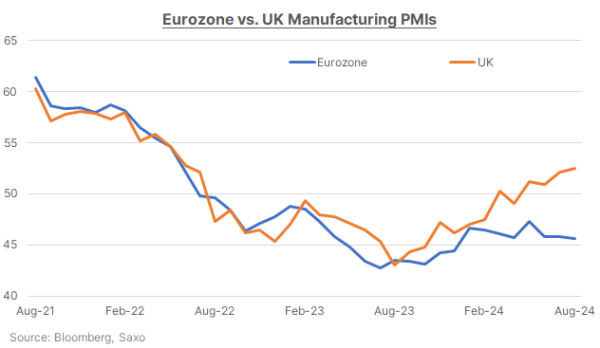

EURGBP: PMI Divergence in Focus

The pound has shown strong performance against the euro this quarter, with EURGBP now trading below the key 0.84 level that has held since 2022. This reflects the diverging economic outlooks and policy approaches between the Eurozone and the UK. Both regions are set to release flash PMIs for September on Monday, and the contrast in manufacturing performance is evident, especially as the UK's momentum has outpaced that of the Eurozone, particularly Germany.

The ECB has already cut rates twice in this cycle, but persistent inflation and a rapidly slowing economy—especially in Germany—are making policymaking challenging. Markets are pricing in an additional 40bps of easing by year-end, with little resistance from ECB officials. In contrast, while the Bank of England began easing in August, its stance remains cautious. Services inflation in the UK is still above 5%, and economic growth remains steady. Governor Andrew Bailey has emphasized that any rate cuts will be gradual, with the need for policy to remain restrictive for an extended period.

Sterling's outlook is further supported by the global environment. With the Federal Reserve starting its rate-cutting cycle, the dollar could weaken, and the pound, with its higher beta, is well-positioned to benefit. This suggests further downside potential for EURGBP, with the April 2022 low of 0.8278 coming into focus.

------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------

Recent FX articles:

- 20 Sep: JPY: Bank of Japan’s Tapering Hawkishness

- 11 Sep: JPY: Upside Fueled by BOJ Hawkishness and Election Volatility

- 4 Sep: JPY: Safe-Haven Appeal on Display, Carry Unwind Risks on the Radar

- 3 Sep: USD at Crossroads: End of Strength or Start of a Crisis?

- 28 Aug: AUD: Short-term Gains, Long-term Risks

- 28 Aug: CAD: Rally at Odds with Fundamentals

- 21 Aug: US Dollar: Excessive Weakness or More to Come?

- 16 Aug: FX Markets Face a Tug-of-War: A Scenario Analysis

- 14 Aug: NZD: Rate Cut Cycle Has Kicked Off

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

Recent Macro articles:

- 19 Sep: Fed’s Jumbo Rate Cut: Short-Term Goldilocks, Long-Term Volatility

- 19 Sep: Fed Rate Cuts Are Here: An ETF Playbook (UCITS)

- 16 Sep: Fed Rate Cuts Are Coming: An ETF Playbook

- 12 Sep: US Votes, Asia Reacts: Investment Strategies for a Trump-Harris Showdown

- 5 Sep: Mastering Diversification: A Comprehensive Guide to Balancing Your Investment Portfolio

- 30 Aug: Nvidia's Blackwell Chips: Raising the Bar in Generative AI

- 15 Aug: Warren Buffett’s Portfolio Shifts: New Bets, Big Buys, and Surprising Exits

- 15 Aug: US CPI: Fed Rate Cut Remains in Play, but 25 vs. 50bps Debate Unsettled

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

Weekly FX Chartbooks:

- 16 Sep: Weekly FX Chartbook: Fed to Start its Rate Cut Cycle

- 9 Sep: Weekly FX Chartbook: Mixed Jobs Data Will Make Fed’s 50bps Cut Harder

- 2 Sep: Weekly FX Chartbook: Labor Data Holds the Key to Size of Fed’s Rate Cut

- 26 Aug: Weekly FX Chartbook: Powell Keeps the Door for 50bps Rate Cut Open

- 19 Aug: Weekly FX Chartbook: Over to Policymakers – Fed’s Powell, Kamala Harris, and BOJ’s Ueda in Focus

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

FX 101 Series:

- 26 Aug: Navigating Portfolio Risks Amid Weakening U.S. Dollar

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar