Weekly FX Chartbook: Powell Keeps the Door for 50bps Rate Cut Open

Key points:

- USD: Downside bias could extend, if risk sentiment continues to hold up

- EUR: Inflation print is unlikely to bring aggressive rate cut expectations

- JPY: Three-legged tailwinds from hawkish Ueda, dovish Powell and Mideast escalation

- GBP: Nothing in pipeline to question BOE’s cautious easing stance

- AUD: CPI and retail sales to test RBA’s rate cut delay resolve

- CAD: BOC rate cuts could remain relatively more aggressive

-------------------------------------------------------------------------------------------------------

USD: Powell Keeps the Door Open to 50bps Cut

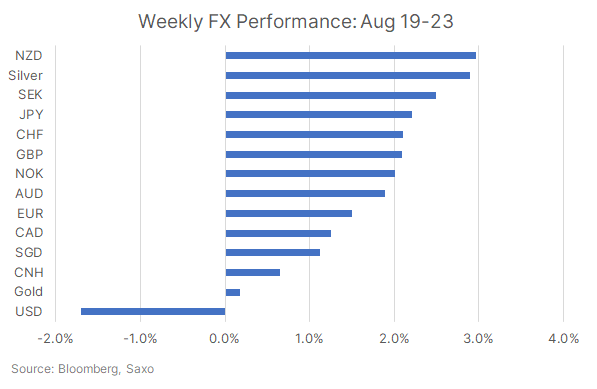

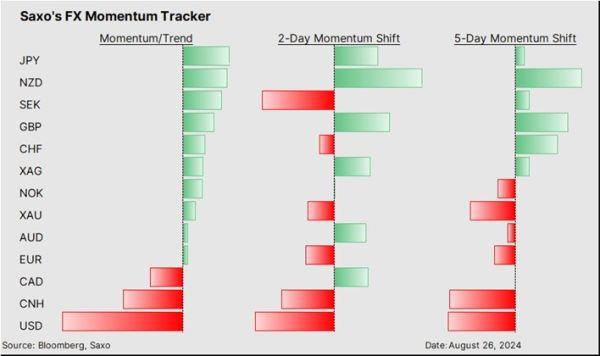

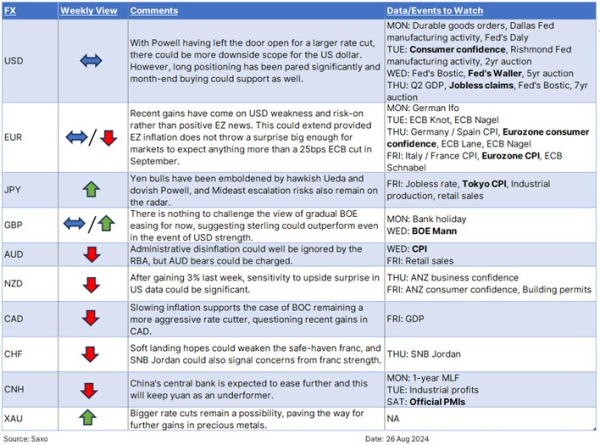

The U.S. dollar was the weakest performer in the G-10 forex space last week, As Fed Chair Powell delivered another policy pivot at the Jackson Hole conference. Powell’s message that the ‘time has come’ for rate cuts provided greater conviction to the markets on a September rate cut. More importantly, he did not close the door for even a 50bps rate cut as he avoided the more careful words used by other Fed members last week hinting at more ‘gradual and ‘methodical’ easing. Chair Powell’s speech also showed greater sensitivity to labour market weakness, in an effort to ensure a soft-landing, suggesting that any further rise in unemployment rate could keep the markets hoping for a 50bps rate cut in September.

This makes the second estimate of Q2 GDP and initial jobless claims (both due Thursday) the key metrics to watch this week. While core PCE deflator remains the Fed’s preferred inflation gauge, the Fed is currently more focused on growth metrics than inflation. This suggests that any upside surprise in core PCE will have to be of significant magnitude to re-ignite inflation concerns.

While the door remaining open to larger Fed rate cuts could mean further US dollar downside this week, there are a few other critical factors to watch, including:

- Nvidia’s earnings remain key for overall risk sentiment that continues to hint towards a soft landing for now. However, any risks of pullback in demand or spending on AI could trigger a sharp reversal in risk sentiment, fueling gains in the US dollar.

- Risks of an escalation in geopolitical tensions also remains a key barometer of risk sentiment.

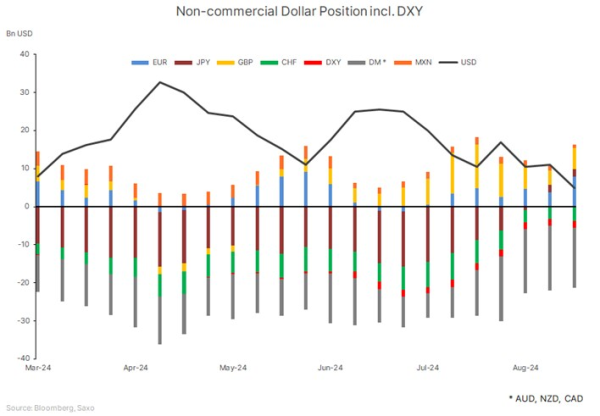

- The CFTC positioning data showed massive selling in the US dollar during the week of August 20, signaling room for short-term consolidation.

- Month-end demand for the US dollar could also underpin.

EUR: Aggressive Rate Cuts Remain Unlikely

The euro has remained remarkably resilient last week despite the dismal PMI numbers from Germany. This is clear proof that unlike the Fed, markets remain more concerned about inflation and wage dynamics in the Eurozone rather than the growth dynamics for now. While the ECB’s measure of negotiated wages did show a slowdown from 4.7% to 3.6% in Q2, the German wage data painted a more concerning picture suggesting that inflation may remain elevated for some time.

Markets are seemingly comfortable expecting less than 25bps of rate cut at the ECB’s September meeting, and less than three full rate cuts priced in for this year. Inflation data this week will have to show a significant upside or downside surprise for this to change. As such, the euro could remain a play on USD moves, rather than on ECB policy expectations for now.

------------------------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------

Recent FX articles and podcasts:

- 21 Aug: US Dollar: Excessive Weakness or More to Come?

- 16 Aug: FX Markets Face a Tug-of-War: A Scenario Analysis

- 14 Aug: NZD: Rate Cut Cycle Has Kicked Off

- 7 Aug: JPY: BOJ’s Back to Being Dovish – Can it Cool the Yen Short Squeeze?

- 6 Aug: AUD: Hard to Buy in RBA’s Hawkishness

- 1 Aug: GBP: Bank of England Cut Won’t Damage Pound’s Resilience

- 31 Jul: JPY: BOJ’s Hawkish Policy Moves Leave Yen at Fed’s Mercy

- 31 Jul: AUD: Softer Inflation to Cool Rate Hike Speculation

- 26 Jul: US PCE Preview: Key to Fed’s Rate Cuts

- 25 Jul: Carry Unwinding in Japanese Yen: The Current Dynamics and Global Implications

- 23 Jul: Bank of Canada Preview: More Cuts on the Horizon

- 16 Jul: JPY: Trump Trade Could Bring More Weakness

- 11 Jul: AUD and GBP: Potential winners of cyclical US dollar weakness

- 3 Jul: Yuan vs. Yen vs. Franc: Shifting Carry Trade Strategies

- 2 Jul: Quarterly Outlook: Risk-on currencies to surge against havens

Recent Macro articles and podcasts:

- 15 Aug: Warren Buffett’s Portfolio Shifts: New Bets, Big Buys, and Surprising Exits

- 15 Aug: US CPI: Fed Rate Cut Remains in Play, but 25 vs. 50bps Debate Unsettled

- 13 Aug: US inflation preview: Is it still too sticky?

- 8 Aug: US Economy: Soft Landing Hopes vs. Hard Landing Fears

- 2 Aug: Singapore REITs: Playing on Potential Fed Rate Cuts

- 30 Jul: Bank of Japan Preview: Exaggerated Expectations, and Potential Impact on Yen, Equities and Bonds

- 29 Jul: Potential Market Reactions to the Upcoming FOMC Meeting

- 25 Jul: Equity Market Correction: How to Position for Turbulence?

- 24 Jul: Powell Put at Play: Rotation, Yen and Treasuries

- 22 Jul: Biden Out, Harris In: Markets Reassess US Presidential Race and the Trump Trade

- 8 Jul: Macro Podcast: What a French election upset means for the Euro

- 4 Jul: Special Podcast: Quarterly Outlook - Sandcastle economics

- 1 Jul: Macro Podcast: Politics are taking over macro

Weekly FX Chartbooks:

- 19 Aug: Weekly FX Chartbook: Over to Policymakers – Fed’s Powell, Kamala Harris, and BOJ’s Ueda in Focus

- 12 Aug: Weekly FX Chartbook: Case for Outsized Fed Cut Bets to be Tested

- 5 Aug: Weekly FX Chartbook: Dramatic Shift in Market Narrative

- 29 Jul: Weekly FX Chartbook: Mega Week Ahead - Fed, BOJ, Bank of England, Australia and Eurozone CPI, Big Tech Earnings

- 22 Jul: Weekly FX Chartbook: Election Volatility and Tech Earnings Take Centre Stage

- 15 Jul: Weekly FX Chartbook: September Rate Cuts and the Rising Trump Trade

- 8 Jul: Weekly FX Chartbook: Focus Shifting Back to Rate Cuts

- 1 Jul: Weekly FX Chartbook: Politics Still the Key Theme in Markets

FX 101 Series:

- 15 May: Understanding carry trades in the forex market

- 19 Apr: Using FX for portfolio diversification

- 28 Feb: Navigating Japanese equities: Strategies for hedging JPY exposure

- 8 Feb: USD Smile and portfolio impacts from King Dollar