What are your options - Amazon earnings trades

What are your options - Amazon earnings trades

Introduction

Amazon (AMZN) remains one of the most influential companies globally, with its earnings reports closely watched by investors and traders. These reports can cause significant stock movements, providing both opportunities and risks for options traders. This article will explore several options trading strategies designed to capitalize on the volatility crush that typically follows an earnings announcement.

Expectations for AMZN stock

Amazon (AMZN) is set to release its earnings report tomorrow night, and there are several key expectations driving market sentiment.

Analysts expect Amazon to report earnings of $1.03 per share, representing a year-over-year increase of 63.49%. The focus will be on Amazon Web Services (AWS) and the North American e-commerce segment. AWS is expected to grow by at least 18%, driven by its strong positioning in the generative AI space. Additionally, Amazon's recent Prime Day event saw double-digit growth in sales, which could positively impact the quarterly results.

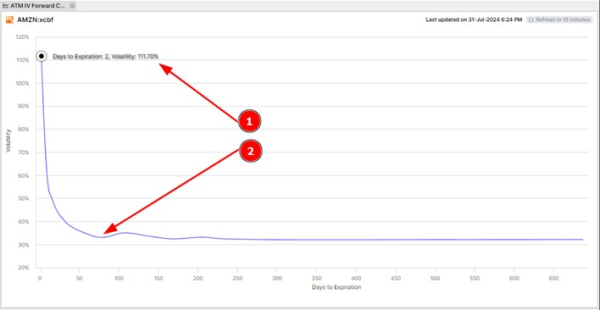

Below is the ATM IV Forward Curve, which clearly shows the drop in implied volatility. Bullet 1 shows the IV of the August 2nd expiry at around 111%, and bullet 2 shows the IV of the October 18th expiry at around 33%. This represents a drop of approximately 78%. If you multiply this drop by the vega value of the August 2nd expiry-leg, you can get an idea of how much this would impact the value of that leg after the earnings release.

Trades to consider

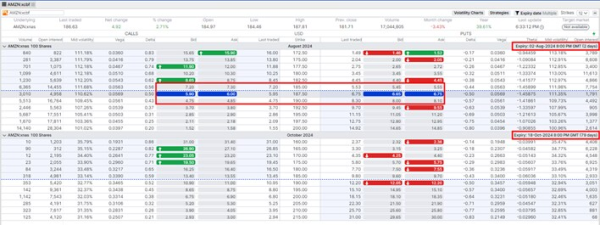

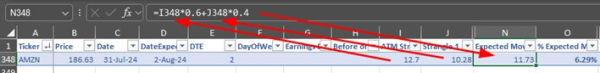

Before diving into specific trades, it's important to consider the expected move, which helps determine the strike prices for our options strategies. Based on the current option pricing, the expected move for Amazon's stock is approximately $11.73. This means we'll set our short strikes at plus or minus $12 from the current stock price. Keep in mind that expected moves are far from a guarantee; they are only a statistical indication based on option pricing.

Important note: the strategies and examples provided in this article are purely for educational purposes. They are intended to assist in shaping your thought process and should not be replicated or implemented without careful consideration. Every investor or trader must conduct their own due diligence and take into account their unique financial situation, risk tolerance, and investment objectives before making any decisions. Remember, investing in the stock market carries risk, and it's crucial to make informed decisions.

In this section, we will explore various options trades tailored to different market outlooks, including bullish, neutral, and bearish strategies. These trades leverage the current high implied volatility environment to maximize potential returns.

Bullish strategies

When adopting a bullish outlook on Amazon (AMZN), several options strategies can take advantage of the current high implied volatility to maximize potential returns. Here are a few strategies that fit this view:

- diagonal call spread: Buying a longer-term call option and selling a shorter-term call option at a higher strike price. This strategy benefits from both a moderate price increase in AMZN stock and the volatility crush post-earnings.

- vertical bull put spread: Selling a put option at a higher strike price and buying another put option at a lower strike price. This strategy profits from a rise in stock price or if the stock remains flat.

- cash secured put: Selling an out-of-the-money put option to collect premium. This is a conservative strategy that generates income and offers the potential to purchase the stock at a lower price.

- short put: Selling an out-of-the-money put option to collect premium, betting that the stock will not fall below the strike price.

- put ratio spread: Selling more put options than are bought, typically selling two puts and buying one at a lower strike. This strategy profits from a rise or limited decline in stock price.

- short put ladder: Selling a put at one strike and buying puts at lower strikes in greater quantity. This strategy benefits from limited downside movement.

- iron condor with bullish bias: A variation of the iron condor where the strikes are set to reflect a bullish bias, benefiting from higher volatility and a slight upward movement.

While there are several bullish strategies, we will focus on the diagonal call spread, which provides a balanced approach to profiting from a moderate rise in Amazon's stock price while taking advantage of the volatility crush. For more information on time spreads, including diagonal spreads, you can listen to our podcast episode on mastering time spreads.

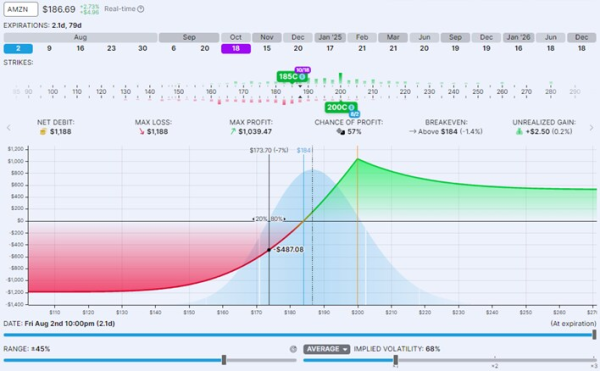

Diagonal call spread

The diagonal call spread involves buying a longer-term call option and selling a shorter-term call option at a higher strike price. This strategy is designed to benefit from both a moderate increase in Amazon's stock price and the expected volatility crush following the earnings announcement.

Example trade:

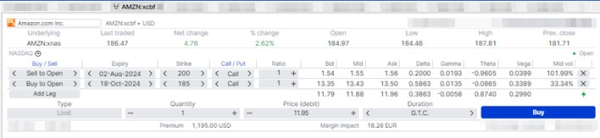

- Buy a call option expiring on October 18, 2024, with a strike price of $185.

- Sell a call option expiring on August 2, 2024, with a strike price of $200.

The provided screenshots show the setup and the potential profit/loss diagram for this trade.

Trade details:

- Net debit: $11.95 per share (or $1,195 total)

- Max loss: $1,195 (if the trade is closed at the expiration of the short leg on August 2)

- Note: If only the short leg is closed and the long leg is kept open, the loss could increase.

- Max profit: $1,039.47 (if the stock price rises to the short strike price at expiration)

- Note: If the stock continues to rise after the short leg expires, profits could increase.

- Breakeven point: $184

Advantages:

- Volatility crush benefit: This trade structure allows the trader to benefit from the decline in implied volatility post-earnings.

- Cost efficiency: Lower upfront cost compared to buying outright calls, reducing the impact of potential losses.

This strategy is ideal for traders expecting a moderate increase in Amazon’s stock price following the earnings report, while also looking to take advantage of the volatility crush that typically occurs after the announcement.

Neutral / range bound strategies

When expecting Amazon (AMZN) to remain within a specific range following its earnings report, several options strategies can take advantage of the current high implied volatility to maximize potential returns. Here are a few strategies that fit this view:

- iron condor: Selling an out-of-the-money call and put while buying further out-of-the-money call and put options for protection. This strategy profits if the stock remains within a specific range.

- iron butterfly: Selling an at-the-money call and put while buying further out-of-the-money call and put options for protection. This strategy profits from minimal movement in the stock price.

- short straddle: Selling both an at-the-money call and put, generating premium income if the stock stays around the current price.

- short strangle: Selling an out-of-the-money call and put, profiting from limited stock movement within a wider range.

While there are several neutral strategies, we will focus on the iron condor, which provides a balanced approach to profiting from a range-bound stock price while taking advantage of the volatility crush.

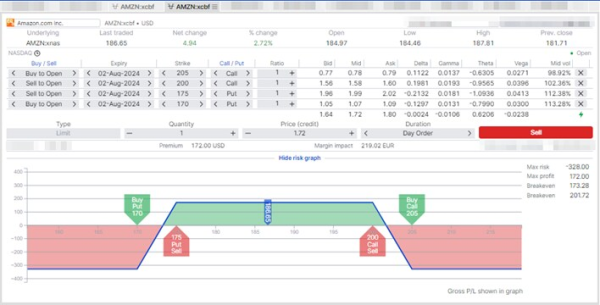

Iron condor

The iron condor involves selling an out-of-the-money call and put while buying further out-of-the-money call and put options for protection. This strategy is designed to benefit from Amazon's stock remaining within a specific range and the expected volatility crush following the earnings announcement.

Example trade:

- Sell a call option expiring on August 2, 2024, with a strike price of $200.

- Buy a call option expiring on August 2, 2024, with a strike price of $205.

- Sell a put option expiring on August 2, 2024, with a strike price of $175.

- Buy a put option expiring on August 2, 2024, with a strike price of $170.

The provided screenshot shows the setup and the potential profit/loss diagram for this trade.

Trade details:

- Net credit: $1.72 per share (or $172 total)

- Max loss: $328 (if the stock moves beyond the bought strikes)

- Max profit: $172 (if the stock remains within the sold strikes)

- Breakeven points: $173.28 and $201.72

Advantages:

- Volatility crush benefit: This trade benefits from the decline in implied volatility post-earnings.

- Premium income: Generates income from the premiums of the sold options, providing a buffer against minor stock movements.

- Risk management: Limited risk on both sides of the trade due to the protective options bought.

This strategy is ideal for traders expecting Amazon's stock to remain within a specific range following the earnings report, while also looking to take advantage of the volatility crush that typically occurs after the announcement.

Bearish strategies

When adopting a bearish outlook on Amazon (AMZN), several options strategies can take advantage of the current high implied volatility to maximize potential returns. Here are a few strategies that fit this view:

- diagonal put spread: Buying a longer-term put option and selling a shorter-term put option at a lower strike price. This strategy benefits from both a moderate price decrease in AMZN stock and the volatility crush post-earnings.

- vertical bear call spread: Selling a call option at a lower strike price and buying another call option at a higher strike price. This strategy profits from a decline in stock price or if the stock remains flat.

- short call: Selling an out-of-the-money call option to collect premium. This is a conservative strategy that generates income and bets that the stock will not rise above the strike price.

- call broken wing butterfly: Combining multiple call options to create a strategy that profits from a limited decline in stock price while protecting against a significant rise.

While there are several bearish strategies, we will focus on the diagonal put spread, which provides a balanced approach to profiting from a moderate decline in Amazon's stock price while taking advantage of the volatility crush. For more information on time spreads, including diagonal spreads, you can listen to our podcast episode on mastering time spreads.

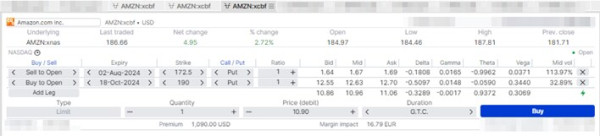

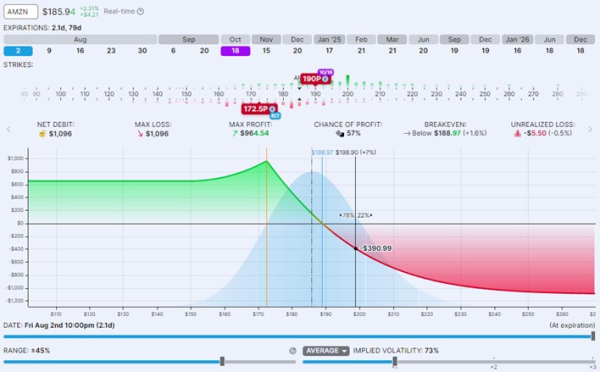

Diagonal put spread

The diagonal put spread involves buying a longer-term put option and selling a shorter-term put option at a lower strike price. This strategy is designed to benefit from both a moderate decrease in Amazon's stock price and the expected volatility crush following the earnings announcement.

Example trade:

- Buy a put option expiring on October 18, 2024, with a strike price of $190.

- Sell a put option expiring on August 2, 2024, with a strike price of $172.5.

The provided screenshots show the setup and the potential profit/loss diagram for this trade.

Trade details:

- Net debit: $10.90 per share (or $1,090 total)

- Max loss: $1,090 (if the trade is closed at the expiration of the short leg on August 2)

- Note: If only the short leg is closed and the long leg is kept open, the loss could increase.

- Max profit: $964.54 (if the stock price drops to the short strike price at expiration)

- Note: If the stock continues to drop after the short leg expires, profits could increase.

- Breakeven point: $188.97

Advantages:

- Volatility crush benefit: This trade structure allows the trader to benefit from the decline in implied volatility post-earnings.

- Cost efficiency: Lower upfront cost compared to buying outright puts, reducing the impact of potential losses.

This strategy is ideal for traders expecting a moderate decrease in Amazon’s stock price following the earnings report, while also looking to take advantage of the volatility crush that typically occurs after the announcement.

Conclusion

Trading Amazon’s earnings with options strategies like diagonal call spreads, iron condors, and diagonal put spreads allows traders to capitalize on the expected volatility crush post-earnings. These trades offer a balanced approach to profiting from various market outlooks, leveraging the decline in implied volatility and providing structured ways to manage risk.

Bullish strategy: The diagonal call spread profits from a moderate increase in Amazon’s stock price and benefits from the volatility crush, with defined risks and potential rewards.

Neutral strategy: The iron condor takes advantage of a range-bound stock price, generating premium income and benefiting from the expected volatility decline, while maintaining limited risk.

Bearish strategy: The diagonal put spread allows traders to profit from a moderate decline in Amazon’s stock price, also leveraging the volatility crush and offering a cost-efficient approach compared to outright puts.

In all these strategies, the key is to understand the potential impact of the volatility crush and to choose the appropriate strikes and expiries based on the expected move. By doing so, traders can effectively manage risks and maximize potential returns.

These strategies are designed to provide a structured way to trade Amazon's earnings, considering both market expectations and volatility dynamics. As always, it's crucial to align trades with individual market outlooks and risk tolerance levels.

Happy trading!

| Previous "What are your options" articles |

|---|

|

| Previous episodes of the "Saxo Options Talk" podcast |

|

| Previous "Investing with options" articles |

|

| Other related articles |

|

| Why options strategies belong in every trader's toolbox |

| Understanding and calculating the expected move of a stock ETF index |

| Understanding Delta - a key guide for Investors and Traders |

|

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Bank's Terms of Use you will find more information on this in the Important Information Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Bank's website.