What are your options - Intel: to trade or not to trade

What are your options: Intel - to trade or not to trade?

Introduction

Intel (NASDAQ: INTC) has been making headlines lately, with reports suggesting a potential $5 billion investment from Apollo Global Management. This news follows previous speculation that Qualcomm might be interested in acquiring the semiconductor giant. While a full acquisition seems unlikely at the moment, such news can cause significant market movements and volatility. For options traders, these conditions present both opportunities and risks.

Even if you decide not to trade Intel at this time, the insights from this article can be applied to other stocks or situations where similar conditions exist, such as high volatility, potential takeover news, or low nominal stock prices. We’ll explore what the options chain indicates and how to approach different trading strategies in various scenarios.Important note: the strategies and examples provided in this article are purely for educational purposes. They are intended to assist in shaping your thought process and should not be replicated or implemented without careful consideration. Every investor or trader must conduct their own due diligence and take into account their unique financial situation, risk tolerance, and investment objectives before making any decisions. Remember, investing in the stock market carries risk, and it's crucial to make informed decisions.

Trading stocks with potential takeover news: What to watch out for

When a company like Intel is involved in takeover speculation, its stock price can become highly volatile. This uncertainty can lead to rapid price movements, often in both directions, as investors react to news and rumors. For options traders, this environment offers opportunities but also requires caution. Here’s what to consider:

- Implied volatility (IV) surge: Takeover news typically drives up implied volatility, increasing options premiums. While selling options in a high-IV environment can be profitable, traders need to be wary of potential price spikes or crashes if news breaks.

- Risk of gaps: In case of a sudden announcement, the stock could gap up or down significantly, potentially breaching multiple strike prices. Defined-risk strategies can help mitigate this risk.

- Time decay consideration: Since such news is speculative, it’s essential to keep an eye on time decay (Theta). If no concrete developments occur, the stock might revert to its pre-news trading range, making long option positions vulnerable.

Implied volatility and options market opportunities

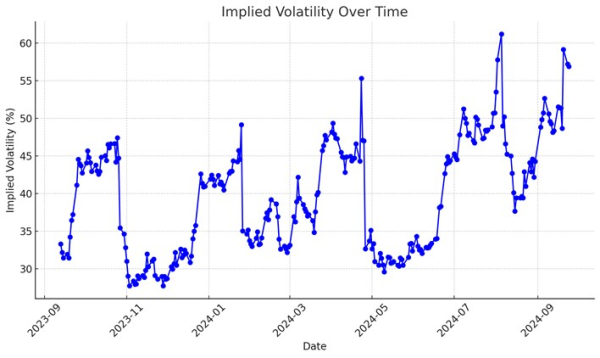

Intel's implied volatility has spiked following the news, creating an interesting landscape for options traders.

Here’s what to consider:

- Current IV levels: Implied volatility is currently elevated. This suggests that the market expects significant movement in the near term. High IV can benefit options sellers, who can collect higher premiums. However, caution is needed to avoid potential sharp moves in the stock.

- Volatility contraction play: If you believe that the hype around the takeover news will subside without a significant move in the stock, a volatility contraction play, such as selling Iron Condors or Iron Butterflies, could be effective.

What the options chain says: Call/put skew

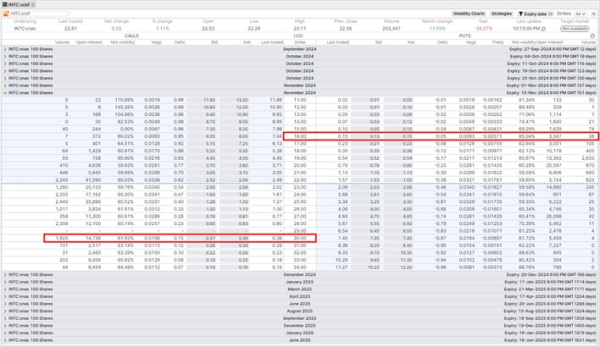

The option chain data for INTC, focusing on the November 15th expiry (51 days out), reveals contrasting signals between implied volatility (IV) skew and price skew. This expiry was chosen because it is far enough to capture market expectations beyond immediate noise yet close enough to reflect the impact of upcoming events like earnings or corporate announcements. The $16 put and $30 call were selected as they are equidistant from the current stock price of $22.81, providing a balanced perspective on how the market is pricing potential movements in both directions.

The $16 put has a higher implied volatility (65.04%) compared to the $30 call (61.93%), indicating a put skew. This suggests that downside protection is relatively more expensive, reflecting market concerns over potential negative developments or a broader risk-off sentiment. However, when looking at the actual option prices, the $30 call ($0.37) is trading significantly higher than the $16 put ($0.15). This price skew implies that traders are placing a premium on upside potential, likely driven by recent speculation around a Qualcomm takeover or a $5 billion investment from Apollo Global Management.

These contrasting signals between IV and price skews highlight a market that is hedging against downside risk while simultaneously speculating on a significant upward move. This dual sentiment reflects a complex market environment where participants are balancing caution with optimism, positioning themselves for potential volatility amidst a backdrop of strategic developments and market speculation.

Options strategies for different scenarios

Based on your outlook for Intel, various options strategies can be considered. Whether you’re expecting a big move, a moderate change, or stability, there are tailored approaches for each scenario. Before executing any of these strategies, it’s essential to enter them into a strategy builder or trading window, such as those available in the SaxoInvestor, SaxoTrader, or SaxoTrader Pro platforms. This allows you to evaluate the potential risk, reward, and profit/loss scenarios, ensuring the trade aligns with your expectations and risk profile. Here are a few strategy ideas to match different market expectations:

- Long straddle or strangle

- Strategy: Buy both a $23 call and $23 put (straddle) or a $25 call and $20 put (strangle) with the November 15th expiry.

- Pro: Profits from large moves in either direction; ideal for high volatility.

- Con: High cost and risk of loss if the stock doesn’t move significantly.

- Risk/profit: Max loss is the premium paid; profit potential is unlimited if the stock makes a big move.

- Strategy: Buy a $23/$28 call spread and a $16 put.

- Pro: Balanced risk-reward, profits from moderate upside while limiting downside risk.

- Con: Limited profit potential due to the capped call spread; premium costs add up.

- Risk/profit: Max loss is the net premium; max profit is the spread width minus net cost. Losses are mitigated by the protective put.

- Strategy: Sell the $27/$32 call spread and the $20/$15 put spread with the November 15th expiry.

- Pro: Allows you to profit from a stable stock price by collecting premium from both the call and put spreads; profits if the stock stays within the range of $20 to $27.

- Con: Risk is defined but should be carefully managed; losses occur if the stock moves outside the expected range.

- Risk/profit: Max loss is $5 per spread minus the premium received; max profit is the total net premium received if the stock remains between $20 and $27 until expiry, offering a balanced 3:1 risk/reward ratio.

- Strategy: Buy one $27 call and sell two $29 calls with the November 15th expiry.

- Pro: Generates a small upfront credit ($0.16); profits from moderate upside while lowering initial cost.

- Con: Risk of unlimited loss if the stock rallies aggressively above $31.16.

- Risk/profit: Max profit of $2.16 at $29; breakeven at $31.16. Unlimited risk beyond $31.16 if the stock rises significantly.

- Strategy: Buy one $23 call, sell two $25 calls, and buy one $30 call with the November 15th expiry.

- Pro: Generates a small credit while allowing for a defined risk; profits from a moderate move up.

- Con: Limited profit range and potential for loss if the stock does not move as expected.

- Risk/profit: Max profit at $25 strike; max loss is the difference between strikes minus credit received. Breakeven at $27.16, offering a favorable risk/reward with a defined loss.

Conclusion: To trade or not to trade?

Intel’s current situation presents both opportunities and challenges for options traders. The elevated implied volatility and takeover speculation create a unique environment, but also come with substantial risks. Whether you decide to trade Intel right now or not depends on your risk tolerance, market outlook, and trading strategy.

Use the information provided here to guide your decision-making, but remember to conduct your own due diligence before entering any position. No single strategy fits all traders, and the right choice will vary based on individual objectives and market conditions. So, to trade or not to trade? That’s a question only you can answer.

As always, stay vigilant and adjust positions as new information emerges. Happy trading!| Previous "What are your options" articles |

|---|

|

| Previous episodes of the "Saxo Options Talk" podcast |

|

| Previous "Investing with options" articles |

|

| Other related articles |

|

| Why options strategies belong in every trader's toolbox |

| Understanding and calculating the expected move of a stock ETF index |

| Understanding Delta - a key guide for Investors and Traders |

|

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Bank's Terms of Use you will find more information on this in the Important Information Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Bank's website.