What are your options: pre-earnings tactics ahead of AMD’s report

What are your options: pre-earnings tactics ahead of AMD’s report

Shares of AMD (NASDAQ) fell 4% on Thursday after the company announced new data center AI chips (AMD Instinct MI325X Accelerators), barely a day after Nvidia executives revealed that their Blackwell GPU products are already "booked out" for the next 12 months. AMD's new AI chip won't begin shipping until Q1 2025, though CEO Lisa Su claims the new platform is superior to Nvidia's in specific benchmarks. This recent dip could be an opportunity or an early sign to alter your outlook ahead of AMD's earnings on October 29, 2024.

Traders are preparing for the volatility that typically surrounds such events. One of the advanced strategies well-suited for this dynamic is the diagonal spread, which allows traders to take advantage of rising implied volatility (IV) ahead of the release and the inevitable post-earnings volatility crush.

In this article, we’ll explore three volatility strategies—bullish, bearish, and neutral—to illustrate how you can structure trades around AMD’s earnings event. We’ll discuss each setup, outline the potential risks and rewards, and provide key insights to help you make informed decisions.

The article has the following sections:

- Understanding earnings volatility

- Calculating the expected move

- Bullish strategy: diagonal call spread

- Bearish strategy: diagonal put spread

- Neutral strategy: iron condor

- Further learning: podcast on time spreads

- Conclusion

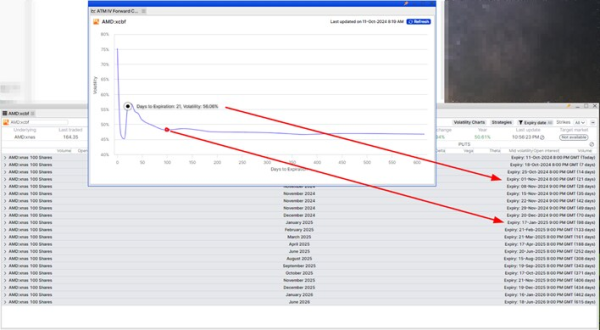

1. Understanding earnings volatility

Historically, AMD’s implied volatility tends to increase in the weeks leading up to earnings and then drops sharply after the release, as the market digests the new information. Below is a chart showing the IV behavior around past earnings dates. The chart shows clearly that the IV, one of the factors that determines the value of an option, gradually builds up in weeks prior to the earnings release. Once the numbers have been published we see the IV suddenly drop. In the last 4 earnings we saw an average drop of around 12% in the day after the earnings publication.

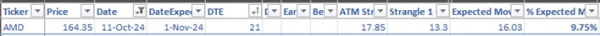

2. Calculating the expected move

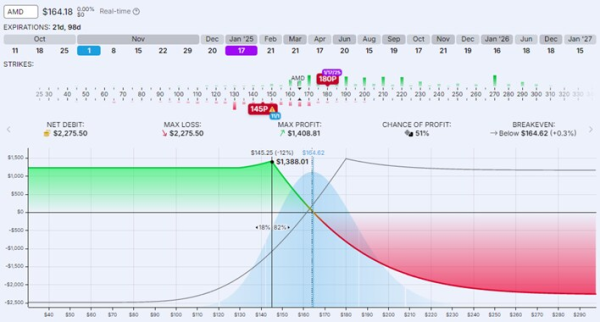

Ahead of earnings, the market is pricing in a 9.75% expected move for AMD, based on the ATM straddle and one-strike strangle prices. With the stock trading at $164.35, this translates into a possible move between $148.32 and $180.38.

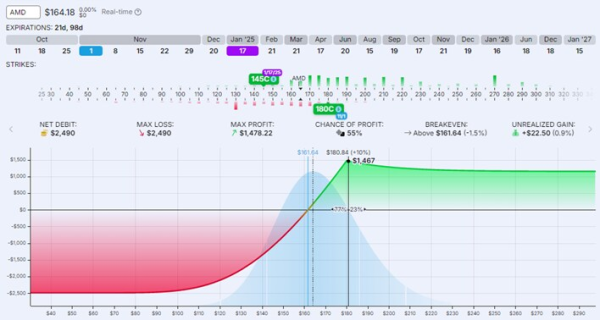

3. Bullish strategy: diagonal call spread

For traders expecting AMD to rise moderately following its earnings, a bullish diagonal call spread offers a way to profit from small gains while limiting risk.

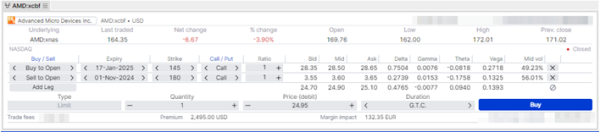

Trade setup:

- Buy to open: January 17, 2025, 145 call

- Sell to open: November 1, 2024, 180 call

- Net debit: $2,490

- Max profit: $1,478.22

- Break-even: $161.64

This strategy benefits from the rising IV leading up to earnings, with maximum profit occurring if AMD moves toward the short call strike of $180. If AMD rises too quickly or doesn’t move enough, the profit potential is capped.

Rationale: The rationale behind this strategy is to capitalize on the dynamics of rising implied volatility (IV) and time decay. Ahead of earnings, IV tends to increase, which boosts the premium of the short-term call you are selling. By selling the November 1, 2024, 180 call, you take advantage of this elevated IV.

The front (short) call decays faster because it has less time until expiration, and you benefit from this faster decay while holding the longer-dated January 17, 2025, 145 call, which decays slower.

If AMD rises moderately toward the $180 strike by November 1, you maximize profit because the short call loses value faster, and the long call retains potential upside. This reduces your cost basis since you’ve collected premium from the short call.

The risk is limited to the net debit paid ($2,490). However, if the price rises beyond $180, the short call caps your profit potential.

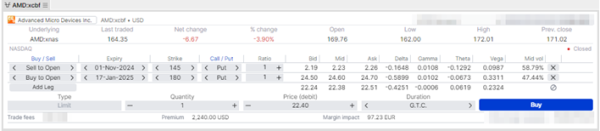

4. Bearish strategy: diagonal put spread

If you expect AMD’s price to decline post-earnings, the bearish diagonal put spread positions you to capitalize on a moderate drop.

Trade setup:

- Buy to open: January 17, 2025, 180 put

- Sell to open: November 1, 2024, 145 put

- Net debit: $2,275.50

- Max profit: $1,408.81

- Break-even: $164.62

This strategy profits if AMD drops toward the short put strike of $145, while the long put retains value due to its later expiration and lower IV.

Rationale: The bearish diagonal put spread works similarly to the bullish call diagonal, but it's designed to profit from a moderate drop in the stock price. Here’s the thought process:

Rising Implied Volatility: Like the bullish trade, this setup benefits from increased implied volatility (IV) leading into earnings, but it uses put options. You sell the November 1, 2024, 145 put, which has elevated IV, and buy the January 17, 2025, 180 put, which benefits from lower IV. The idea is to take advantage of higher premiums in the short-term expiration.

Time Decay (Theta): The short-term put decays faster as it approaches expiration, while the longer-term put decays slower. If AMD’s price moves towards $145 (the short put), you can benefit from the faster decay of the short put’s value.

Moderate Price Decline: This strategy profits from a moderate decline in AMD’s price, ideally toward the $145 strike. If AMD drops to or near this level by November 1, the short put loses value quickly while the long put retains its value, maximizing the potential for profit.

Limited Risk: The risk is limited to the net debit paid ($2,275.50). If AMD stays flat or rises, the trade can lose value, but the long put provides protection by limiting losses to the premium paid.

In summary, the trade takes advantage of the post-earnings IV collapse, slower decay in the longer-term put, and the faster decay in the short-term put, aiming to capitalize on a moderate bearish move in AMD.

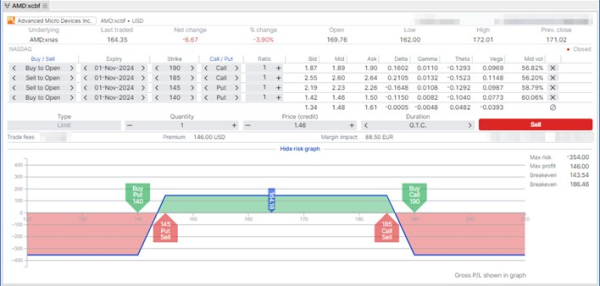

5. Neutral strategy: iron condor

For traders expecting AMD to remain within a defined range post-earnings, a neutral iron condor offers limited risk while capitalizing on minimal price movement.

Trade setup:

- Sell to open: November 1, 2024, 185 call and 145 put

- Buy to open: November 1, 2024, 190 call and 140 put

- Net credit: $1.46

- Max profit: $146

- Break-even: $143.54 (lower), $186.46 (upper)

This trade profits as long as AMD stays within the $145 to $185 range, with max risk limited to $354. Large price swings outside this range will result in losses.

Rationale: The neutral iron condor is designed to profit from low volatility and a range-bound price after earnings. Here's how it works:

Range-bound Expectation: This strategy is used when you expect minimal price movement after the earnings announcement. You’re betting that AMD will stay within a defined range (in this case, between $145 and $185) by the expiration date (November 1, 2024). This is ideal when you believe the post-earnings volatility will drop, and no significant price movement is expected.

Time Decay (Theta): The iron condor takes advantage of time decay because all options involved are short-dated. The closer the options get to expiration without breaching the strike prices, the more value they lose, allowing you to keep the credit received upfront.

Limited Risk: The risk in this trade is limited to the difference between the strikes minus the premium received (in this case, $354). As long as AMD remains between the sold strikes ($145 and $185), you keep the net credit as profit.

Profit from Lack of Movement: The ideal scenario is for AMD to stay between the short strikes ($145 and $185). If this happens, all the options expire worthless, and you collect the maximum profit. However, if AMD’s price moves beyond this range, the trade starts losing money due to the exercised short options.

In summary, the neutral iron condor is a low-risk, limited-reward strategy that benefits from minimal movement and declining implied volatility after earnings. It’s best used when you expect AMD to remain within a tight price range after the event.

6. Further learning: podcast on time spreads

For those looking to deepen their understanding of time spreads—including calendar and diagonal spreads—I recommend checking out this detailed podcast episode.

This episode covers:

- The principles of time decay and how to manage it in options strategies.

- How to optimize diagonal and calendar spreads for different market conditions.

- The impact of volatility on time spreads and how to navigate earnings releases.

If you're interested in mastering these advanced options strategies, the podcast provides clear, actionable insights that can complement the strategies discussed in this article.

7. Conclusion

Diagonal spreads are a powerful tool for capitalizing on earnings-related volatility, but they require careful planning and risk management. Whether you are bullish, bearish, or neutral on AMD, these strategies allow you to structure trades that benefit from volatility changes while capping risk.

As always, practice proper risk management and consider your outlook carefully before executing these trades.

| Previous "What are your options" articles |

|---|

|

| Previous episodes of the "Saxo Options Talk" podcast |

|

| Previous "Investing with options" articles |

|

| Other related articles |

|

| Why options strategies belong in every trader's toolbox |

| Understanding and calculating the expected move of a stock ETF index |

| Understanding Delta - a key guide for Investors and Traders |

|

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Bank's Terms of Use you will find more information on this in the Important Information Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Bank's website.