What are your options - Russell 2000 ETF rotation trades

Introduction

In today's dynamic financial markets, traders and investors are continually seeking opportunities to maximize their returns while managing risk. One such opportunity lies in trading options on the iShares Russell 2000 ETF (IWM). This ETF, which tracks the performance of the Russell 2000 Index, offers a diverse portfolio of small-cap stocks that can provide significant growth potential. With current market conditions characterized by heightened implied volatility, the premiums received from selling options are more attractive than they have been in recent months. This article will explore various medium to short-term IWM trades, highlighting bullish, neutral, and bearish strategies to suit different market outlooks. Whether you are a seasoned trader or just starting, understanding these strategies can help you navigate the market more effectively.

Why does the Russell 2000 attract our interest?

The Russell 2000 Index, which represents the smallest 2,000 stocks in the Russell 3000 Index, is a benchmark for small-cap stocks in the U.S. market. Here are a few key reasons why it attracts our interest:

- Representation of small-cap stocks: The Russell 2000 includes a broad spectrum of small-cap companies, providing a comprehensive view of this segment of the market. These companies often have higher growth potential compared to larger, more established firms.

- Economic sensitivity: Small-cap stocks are typically more sensitive to domestic economic conditions. They can provide a barometer for the U.S. economy's overall health, as these companies are generally more focused on the domestic market than larger multinational corporations.

- Volatility and opportunity: Small-cap stocks tend to be more volatile than large-cap stocks. This higher volatility can create more trading opportunities for those looking to capitalize on short-term market movements.

- Diversification: Investing in the Russell 2000 provides diversification across a wide range of industries and sectors, which can help mitigate risk compared to investing in individual small-cap stocks.

- Rotation from big tech to mid-cap: Recently, there has been a noticeable shift in trading volume from large-cap technology stocks to small and mid-cap stocks. This rotation suggests that investors are seeking opportunities outside the big tech names that have dominated the market.

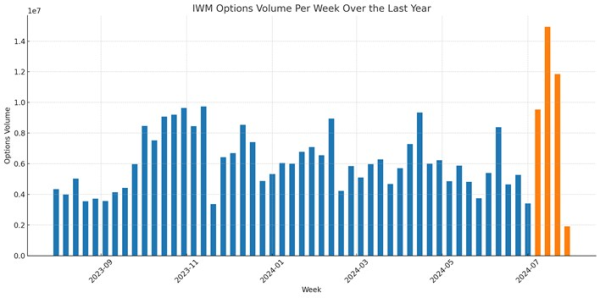

The chart below illustrates the heightened options volume for IWM over the past three weeks (not including the current week, which has just started). This increase in volume supports the observation of a rotation from big tech to mid-cap stocks, indicating growing interest and activity in the Russell 2000. The elevated options volume also suggests that traders are positioning themselves to take advantage of potential movements in the small-cap segment.

Why the IWM?

The iShares Russell 2000 ETF (IWM) is a popular choice for traders and investors seeking exposure to the small-cap segment of the U.S. market. Here’s why:

- Liquidity: IWM is one of the most liquid ETFs, ensuring tight bid-ask spreads and lower trading costs.

- Diversification: It provides exposure to a broad range of small-cap stocks, offering diversification across multiple sectors.

- Convenience: IWM offers a simple and efficient way to invest in the Russell 2000 Index, making it easier to implement various trading strategies, including options.

- High trading volume: The high trading volume in IWM options, as shown in the recent weeks, indicates strong interest and provides ample opportunities for options trading.

These factors make IWM a suitable vehicle for both short-term trades and long-term investments in the small-cap market.

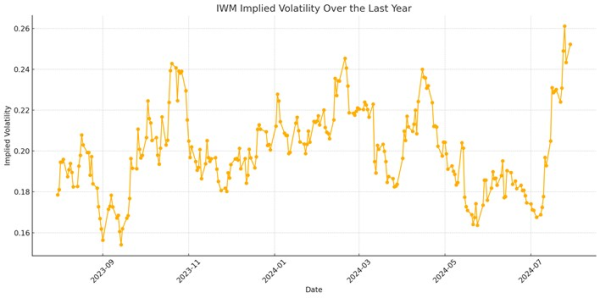

Implied volatility is high

Implied volatility (IV) is a measure of the market's expectation of future volatility and plays a crucial role in options pricing. Currently, IWM's implied volatility is in the highest range of the year, as shown in the chart below. This elevated IV environment presents a unique opportunity for options traders.

Higher implied volatility means that the premiums for options are richer, making it an ideal time to sell options. When IV is high, traders can collect more premium or take on less risk while still receiving a good amount of premium. By selling options in this environment, traders can enhance potential returns and benefit from the elevated premiums.

Additionally, if volatility decreases after the trade is initiated, the value of the sold options may drop, allowing traders to buy them back at a lower price for a profit.

Overall, the current high implied volatility in IWM makes it a good candidate for premium selling strategies, offering the potential for higher income and favorable risk-reward scenarios.

Some trades

In this section, we will explore various IWM options trades tailored to different market outlooks, including bullish, neutral, and bearish strategies. These trades leverage the current high implied volatility environment to maximize potential returns.

Important note: the strategies and examples provided in this article are purely for educational purposes. They are intended to assist in shaping your thought process and should not be replicated or implemented without careful consideration. Every investor or trader must conduct their own due diligence and take into account their unique financial situation, risk tolerance, and investment objectives before making any decisions. Remember, investing in the stock market carries risk, and it's crucial to make informed decisions.

In this section, we will explore various IWM options trades tailored to different market outlooks, including bullish, neutral, and bearish strategies. These trades leverage the current high implied volatility environment to maximize potential returns.

Bullish strategies

When adopting a bullish outlook on IWM, several options strategies can take advantage of the current high implied volatility to maximize potential returns. Here are a few strategies that fit this view:

- Bull Put Spread: Selling a put option at a higher strike price and buying another put option at a lower strike price.

- Short Put: Selling an out-of-the-money put option to collect premium.

- Put Ratio Spread: Selling more put options than are bought, typically selling two puts and buying one at a lower strike.

- Short Put Ladder: Selling a put at one strike and buying puts at lower strikes in greater quantity.

- Iron Condor with Bullish Bias: A variation of the iron condor where the strikes are set to reflect a bullish bias, benefiting from higher volatility and a slight upward movement.

Bull put spread

One effective bullish strategy that takes advantage of the current high implied volatility in IWM is the bull put spread. This strategy involves selling a put option at a higher strike price and buying another put option at a lower strike price with the same expiration date. It allows traders to collect premium while limiting their risk.

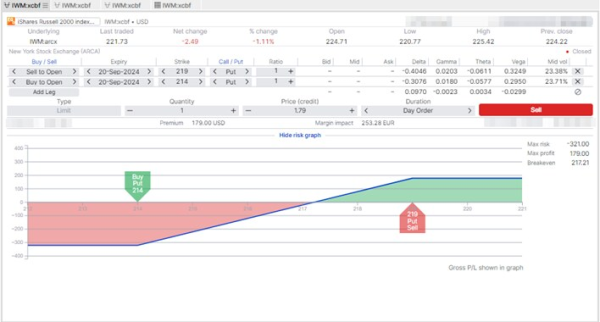

In the first trade setup, the above screenshot presents a bull put spread on IWM, which is an options strategy entailing the sale of a put option while simultaneously purchasing another put with the same expiration date and a lower strike price. Here's the detailed setup:

- Sell to Open: 1 Put with a Strike Price of $219, Expiry 20-Sep-2024

- Buy to Open: 1 Put with a Strike Price of $214, Expiry 20-Sep-2024

This configuration results in a net credit (premium) of $179.00 USD.

Financial implications:

- Maximum Risk (Max Loss): The max risk you're exposed to is $321.00. This scenario unfolds if IWM's price plunges below $214 by the expiration date, causing both puts to be in-the-money. The loss is the spread between the strike prices ($5) minus the premium received ($1.79 per share).

- Maximum Profit (Max Gain): The max profit is capped at the premium of $179.00. You achieve this if IWM stays above the sold strike price of $219 by expiration, rendering both puts worthless.

- Break-even Point: The break-even for this trade is $217.21, which is the higher strike minus the premium received per share ($219 - $1.79).

Market analysis:

- Premium: The collected premium is substantial, reflecting the options market's implied volatility for IWM. High premiums are typical with assets like IWM, where substantial price moves can occur.

- Stock performance: Considering IWM's market behavior, your trade suggests confidence that the ETF will remain flat or appreciate, staying above your break-even at expiration.

- Volatility: Given the option Greeks shown, you benefit from a decline in volatility and time decay, which is characteristic of a credit spread strategy.

Strategic summary: This bullish position on IWM implies a forecast that the ETF will not decrease significantly and is likely to maintain or increase in value, staying above the break-even level. By employing this credit spread, you're taking advantage of the received premium, which provides a cushion against modest drops in the ETF's price. Your obligation is to purchase IWM shares at $219 if it falls below this level, but you've hedged with the right to sell at $214. The net credit received bolsters your stance as long as IWM's price stays above $217.21 by expiration.

Neutral / range bound strategies

When expecting IWM to trade within a specific range, several options strategies can capitalize on the current high implied volatility to generate returns. Here are a few strategies that fit this view:

- Iron Condor: Involves selling an out-of-the-money call spread and an out-of-the-money put spread. This strategy profits if IWM remains within the range defined by the strike prices of the sold options.

- Calendar Spread: Entails buying and selling options with the same strike price but different expiration dates. This strategy benefits from time decay and can be adjusted to target specific price ranges.

- Butterfly Spread: Comprises buying one in-the-money call (or put), selling two at-the-money calls (or puts), and buying one out-of-the-money call (or put). This strategy profits from low volatility and IWM staying close to the middle strike price.

- Strangle: Involves selling an out-of-the-money call and an out-of-the-money put. This strategy profits if IWM stays within the range defined by the strike prices of the sold options, although it carries higher risk than other neutral strategies.

By utilizing these neutral or range-bound strategies, traders can capitalize on high implied volatility by collecting premium while positioning themselves to profit from IWM trading within a specific range.

Iron Condor In-Depth

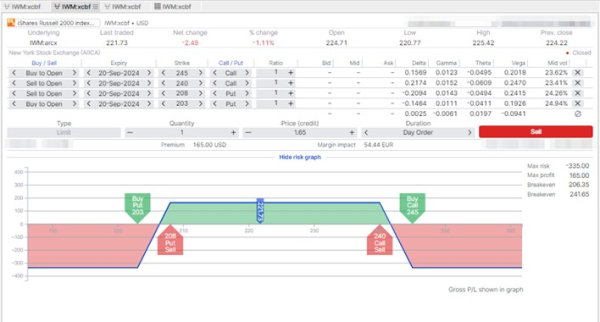

In this section, we'll go in-depth on the iron condor strategy shown in the screenshot below. The iron condor is an options strategy designed to profit from high implied volatility that drops to a lower level in the underlying asset, in this case, IWM. It involves selling an out-of-the-money call spread and an out-of-the-money put spread.

Here's the detailed setup:

- Sell to Open:

- 1 Put with a strike price of $208, Expiry 20-Sep-2024

- 1 Call with a strike price of $240, Expiry 20-Sep-2024

- Buy to Open:

- 1 Put with a strike price of $203, Expiry 20-Sep-2024

- 1 Call with a strike price of $245, Expiry 20-Sep-2024

This configuration results in a net credit (premium) of $165.00 USD.

Financial implications:

- Maximum Risk (Max Loss): The max risk you're exposed to is $335.00. This scenario unfolds if IWM's price falls below $203 or rises above $245 by the expiration date. The loss is the difference between the strike prices of the put (or call) spreads minus the premium received.

- Maximum Profit (Max Gain): The max profit is capped at the premium of $165.00. You achieve this if IWM stays between the sold strike prices of $208 and $240 by expiration, rendering all options worthless.

- Break-even Points: The break-even points for this trade are $206.35 (the lower strike price of $208 minus the premium received) and $241.65 (the higher strike price of $240 plus the premium received).

Market analysis:

- Premium: The collected premium is substantial, reflecting the options market's implied volatility for IWM. High premiums are typical with strategies like the iron condor, where substantial price moves are less likely.

- Stock performance: Considering IWM's market behavior, your trade suggests confidence that the ETF will remain within the range of $208 to $240 by expiration.

- Volatility: Given the option Greeks shown, you benefit from a decline in volatility and time decay, which is characteristic of a credit spread strategy like the iron condor.

Strategic summary: This neutral position on IWM implies a forecast that the ETF will not experience significant price swings and will stay within the defined range. By employing this credit spread, you're taking advantage of the received premium, which provides a cushion against modest price movements. Your obligation is to buy IWM shares at $208 if it falls below this level and sell at $240 if it rises above this level, but you've hedged with the right to sell at $203 and buy at $245, respectively. The net credit received bolsters your stance as long as IWM's price stays within the break-even range by expiration.

Bearish strategies

When adopting a bearish outlook on IWM, several options strategies can take advantage of the current high implied volatility to maximize potential returns. Here are a few strategies that fit this view:

- Bear call spread: Involves selling a call option at a lower strike price and buying another call option at a higher strike price. This strategy benefits from high implied volatility by collecting more premium.

- Short call: Selling an out-of-the-money call option to collect premium, expecting the underlying asset to decline or stay below the strike price.

- Call broken wing butterfly: A variation of the butterfly spread, involving buying a call option at a lower strike, selling two calls at a middle strike, and buying another call at a higher strike but with a wider gap. This strategy benefits from high implied volatility and provides a potential profit if the underlying asset falls.

- Put diagonal spread: Involves buying a longer-term put option and selling a shorter-term put option at a different strike price. This strategy benefits from high implied volatility and a bearish outlook on the underlying asset.

By utilizing these bearish strategies, traders can capitalize on high implied volatility by collecting premium or positioning themselves to profit from a decline in IWM's price.

Bear call spread in-depth

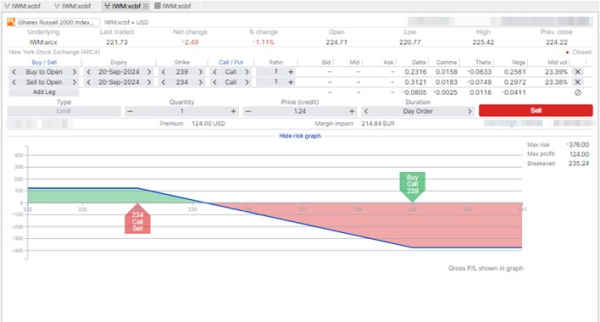

In this section, we'll go in-depth on the bear call spread strategy shown in the screenshot below. The bear call spread is a bearish options strategy designed to profit from a decline in the underlying asset, in this case, IWM. It involves selling a call option at a lower strike price and buying another call option at a higher strike price with the same expiration date.

Here's the detailed setup:

- Sell to Open:

- 1 Call with a strike price of $234, Expiry 20-Sep-2024

- Buy to Open:

- 1 Call with a strike price of $239, Expiry 20-Sep-2024

This configuration results in a net credit (premium) of $124.00 USD.

Financial implications:

- Maximum Risk (Max Loss): The max risk you're exposed to is $376.00. This scenario unfolds if IWM's price rises above $239 by the expiration date. The loss is the difference between the strike prices ($5) minus the premium received ($1.24 per share).

- Maximum Profit (Max Gain): The max profit is capped at the premium of $124.00. You achieve this if IWM stays below the sold strike price of $234 by expiration, rendering both calls worthless.

- Break-even Point: The break-even for this trade is $235.24, which is the higher strike price of $234 plus the premium received per share ($1.24).

Market analysis:

- Premium: The collected premium is substantial, reflecting the options market's implied volatility for IWM. High premiums are typical with strategies like the bear call spread, where substantial price moves are less likely.

- Stock performance: Considering IWM's market behavior, your trade suggests confidence that the ETF will remain below the strike price of $234 by expiration.

- Volatility: Given the option Greeks shown, you benefit from a decline in volatility and time decay, which is characteristic of a credit spread strategy like the bear call spread.

Strategic summary: This bearish position on IWM implies a forecast that the ETF will not experience significant price increases and will stay below the defined strike price. By employing this credit spread, you're taking advantage of the received premium, which provides a cushion against modest price movements. Your obligation is to sell IWM shares at $234 if it rises above this level, but you've hedged with the right to buy at $239. The net credit received bolsters your stance as long as IWM's price stays below $235.24 by expiration.

Conclusion

In the current market environment, characterized by heightened implied volatility, the iShares Russell 2000 ETF (IWM) presents a variety of attractive trading opportunities. By understanding and employing different options strategies, traders can effectively capitalize on market conditions while managing risk.

For those with a bullish outlook, strategies such as the bull put spread allow for premium collection and defined risk. Neutral traders can benefit from strategies like the iron condor, which profits from IWM remaining within a certain range. Bearish traders can leverage strategies like the bear call spread to profit from a potential decline in IWM.

Each strategy discussed leverages the high implied volatility to maximize potential returns, making IWM a versatile and promising vehicle for options traders. As always, it is crucial to consider your own risk tolerance and market outlook when selecting and implementing these strategies. By carefully analyzing market conditions and strategically positioning your trades, you can navigate the market with greater confidence and effectiveness.

Happy trading!

| Previous "What are your options" articles |

|---|

|

| Previous episodes of the "Saxo Options Talk" podcast |

|

| Previous "Investing with options" articles |

|

| Other related articles |

|

| Why options strategies belong in every trader's toolbox |

| Understanding and calculating the expected move of a stock ETF index |

| Understanding Delta - a key guide for Investors and Traders |

|

Options are complex, high-risk products and require knowledge, investment experience and, in many applications, high risk acceptance. We recommend that before you invest in options, you inform yourself well about the operation and risks. In Saxo Bank's Terms of Use you will find more information on this in the Important Information Options, Futures, Margin and Deficit Procedure. You can also consult the Essential Information Document of the option you want to invest in on Saxo Bank's website.