What could restore the negative correlation between stocks and sovereign bonds?

The historical negative correlation between stocks and sovereign bonds broke abruptly in 2022 as the US Federal Reserve (Fed) began tightening its monetary policy to fight multi-decade high US inflation.

60/40 portfolios recorded one of their worst performances on record.

In this article, we discuss what could restore the negative correlation between stocks and sovereign bonds, and what could make gold regain its status as hedge against market selloff and inflation.

One of the most popular investment portfolios is known as 60/40 portfolio, where 60% of the portfolio is allocated to stocks, and the remaining 40% to bonds.

The idea behind the 60/40 portfolio is that, in times of market distress — when the higher-risk stocks fall, investors seek refuge in safer assets.

Hence, lower-risk sovereign bonds tend to remain resilient to market headwinds.

This market behaviour results in a negative correlation between stocks and sovereign bonds. When stock prices fall, bond prices tend to rise. Likewise, when stock prices rise, bond prices have a better chance to fall.

Allocating a part of a portfolio in government bonds helps investment portfolios to temper periods of stock selloff and offers a good hedge to the overall portfolio performance…

… only, and if only the negative correlation between stocks and bonds holds.

2022 was marked by an unusual positive correlation between stocks and bonds.

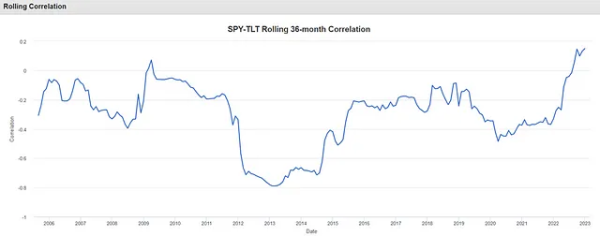

The 36-month rolling correlation between the SPDR’s S&P500 ETF and iShares 20+ year treasury bond ETF turned positive, and became increasingly more positive through the course of the year.

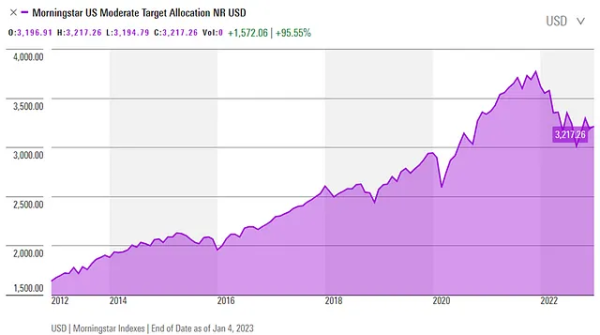

The implication for investors was devastating; the 60/40 portfolios remained powerless faced with the everything selloff. The Morningstar’s US Moderate Target Allocation Index, which is designed as a benchmark for a 60/40 allocation portfolio, lost more than 15% within a year — slightly less than the S&P500 which ended the year around 20% down.

The question is, why did the negative correlation between stocks and sovereign bonds break so abruptly?

The answer is: because of the Federal Reserve (Fed)!

Finally convinced that inflation was not transitory and that it won’t go away by itself, the Fed announced by the end of 2021 that it will start raising the interest rates and reduce the size of its balance sheet.

Both are bad for bond prices.

- Higher interest rates directly impact bond valuations, and the Fed raised the interest rates by 425bp in 2022,

- Quantitative Tightening (QT), on the other hand, means that the Fed stopped buying massive amounts of US sovereign bonds to pump money into the financial system. US sovereigns lost their biggest buyer.

As a result, the US government bonds started diving. The short-end of the US yield curve — which is more sensitive to interest rate hikes, rose more rapidly than the longer-end. The US 10-year yield kicked off the year around 1.50% and jumped to 4.25%, while the 2-year yield soared from around 0% in September 2021 to 4.75% in November 2022.

During the same period, equity valuations got hammered by tightening financial conditions and recession worries.

In conclusion, the Fed’s aggressively hawkish monetary policy shift was responsible for both the stock and the bond market meltdown.

The inversion of the US yield curve increased odds of recession in 2023.

Recession.

Recession is one factor that could restore the negative correlation between US stocks and sovereign bonds based on two distinct market responses.

1. Slowing economic activity would weigh on companies’ profits and profit expectations and further weigh on their valuations.

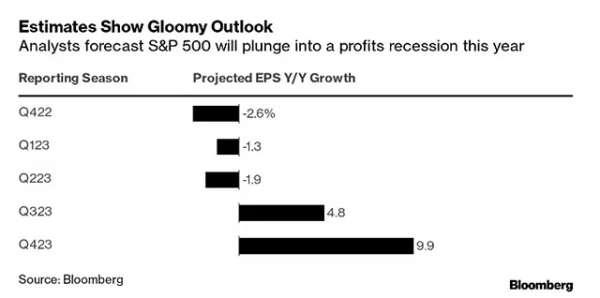

According to a Bloomberg survey, S&P500 companies’ profits are estimated to fall by 2.6% in the final quarter of 2022. Profits will likely continue declining by 1.3% in the first quarter of this year, fall another 1.9% in the second quarter, before recovering from the third quarter onwards.

2. Simultaneously, recession would also temper the Fed’s hawkish monetary policy stance, slow down, stop, or even reverse the interest rate hikes.

Consequently, the risk-off investors would continue exiting stocks on profit recession — and not on hawkish Fed expectations, and they would go back to bonds, restoring the negative correlation between stocks and bonds.

The deeper the recession, the bigger the stock selloff, the softer the Fed expectations, the softer the sovereign yields, the higher the sovereign bond prices and the higher the negative correlation between stocks and sovereign bonds.

Deep recession, mild recession, or no recession, we will likely see the US bonds recover before stocks.

What we fear however is that the Fed’s balance sheet remains relatively big, and that the QT could slow down recovery in bond prices after a decade-and-a-half long aggressive bond buying.

In all cases, the US economic data, especially the inflation, jobs and growth data, will say the last word on whether the Fed expectations will, or will not stay in the driver’s seat.

If the markets continue to be driven by hawkish Fed expectations, stocks and sovereign bonds would continue to fall hand in hand.

BUT IF recession fears become the major market catalyzer, then we shall see stocks and bonds diverge in favour of the latter.

Gold is also a go-to asset for investors seeking refuge in shaky market conditions. Yet, as the US sovereign bonds, gold offered poor hedging to its holders through the 2022 financial turmoil.

As the US sovereign yields soared, the opportunity cost of holding the non-interest-bearing gold rose and limited inflows into the yellow metal.

As such, gold closed 2022 flat despite a decent market rout and rising inflation.

But, the precious metal should benefit from the easing upside pressure in US yields, and could well benefit from risk-off inflows, especially if inflation remains high, and recession fears keep risk appetite limited for more risky, better-yielding assets.

In this respect, the price of an ounce could flirt with the $2000 per ounce in the next nine to twelve months.

Want to know more? Follow upcoming webinars on: www.swissquote.com/webinars and download our e-books on this topic at www.swissquote.com/education