What to expect from the BoC decision❓

📉Canadian dollar weakens ahead of Central Bank decision

The Bank of Canada (BoC) is expected to cut interest rates for a third consecutive policy meeting. Concerns about inflation in the Canadian economy are fading, and BoC officials are increasingly paying more attention to the weakening labor market.

Key points from today’s BoC decision:

- Bankers’ decision will be announced at 2:45 pm BST. A press conference with BoC chief Governor Macklem is scheduled for 3:30 pm BST.

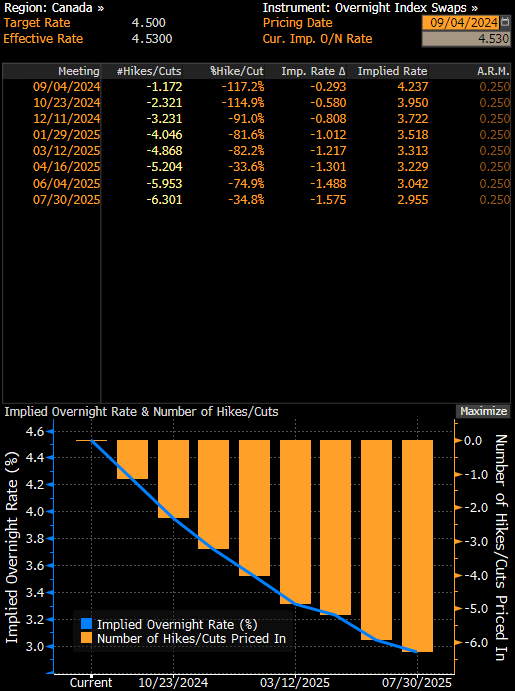

- The 25 basis point rate cut has been fully priced in by the market. There is a 17% probability of a 50 basis point rate cut.

- With such a market valuation, the materialization of a 25-point cut scenario + indications of a more conservative stance by bankers could strengthen the Canadian dollar despite the cut

- By the end of this year, the market estimates that the rate cuts will amount to a total of 81bp (for comparison, in the US it is 104bp, for the UK 43bp, for the eurozone 61bp, and for Switzerland 53bp)

- Economists surveyed by Bloomberg predict that the Bank of Canada will cut rates by a quarter of a percentage point at each of the next five meetings, and the reference rate will fall to 3% by mid-2025. This would place it in the bank's so-called neutral range, an estimated level at which interest rates neither slow down nor stimulate the economy.

Source: Bloomberg Financial LP

Macroeconomic environment:

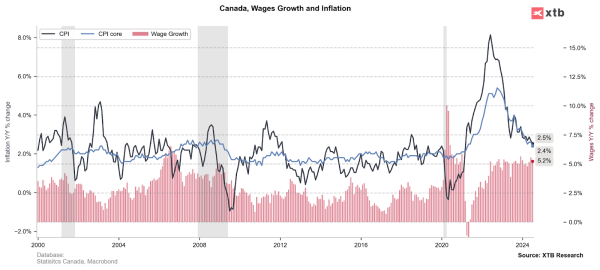

In June, BoC Governor Macklem became the first Group of Seven central banker to ease monetary policy. Officials have signaled that it is “reasonable” to expect further cuts if annual price increases continue to slow. Inflation has now been within the bank’s 1% to 3% control range for seven months, reaching 2.5% in July. Fundamental measures of the economy are also slowing, putting pressure on easing monetary conditions in the economy.

Inflation pressures are falling in Canada, with wage pressures stabilizing as well. Source: XTB

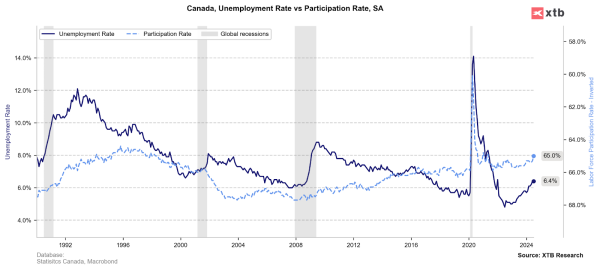

The unemployment rate rose to 6.4% from 5% at the beginning of last year. Source: XTB

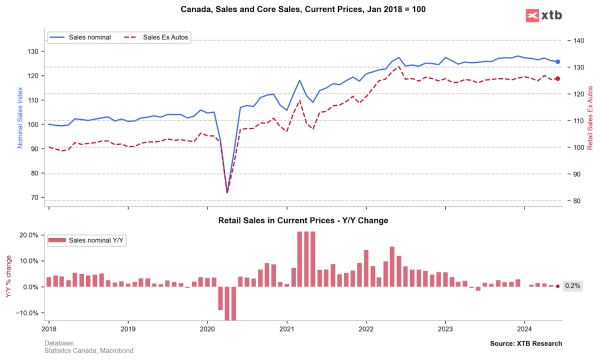

Canadian consumers are feeling the effects of higher borrowing costs, and household consumption per person remains low. Source: XTB

The bank confirmed that it is starting to focus more on downside risks to the economy. In a summary of the July meeting, officials said they spent “a fair amount” of time discussing the country’s weakening labor market. It has also become clear since July that the Federal Reserve will soon cut interest rates. This should help dispel concerns that Macklem will overtake Canada’s largest trading partner too quickly, a scenario that would risk putting pressure on the Canadian dollar. Canada’s economy grew at an annual rate of 2.1% in the second quarter, but most of the growth was driven by government spending, and early signs suggest that it will slow down in the third quarter.

A look at the USDCAD pair:

The USDCAD pair is holding at yesterday’s intraday high zone at the beginning of today’s session. After a dynamic downtrend that began in early August, there was a rebound that halted the declines in the zone of 1.34355 Canadian dollars. In the medium term, it seems that the overall upward trend has not broken. The most important control point, which could indicate the dominance of bulls or bears, may be the zone of intersection of 50-, 100- and 200-day exponential moving averages, which define the technical embracing of the downtrend. The key support point, however, remains the zone of local lows from the end of August. Source: xStation

The USDCAD pair is holding at yesterday’s intraday high zone at the beginning of today’s session. After a dynamic downtrend that began in early August, there was a rebound that halted the declines in the zone of 1.34355 Canadian dollars. In the medium term, it seems that the overall upward trend has not broken. The most important control point, which could indicate the dominance of bulls or bears, may be the zone of intersection of 50-, 100- and 200-day exponential moving averages, which define the technical embracing of the downtrend. The key support point, however, remains the zone of local lows from the end of August. Source: xStation