What will RBNZ do tomorrow?

Reserve Bank of New Zealand will announce its next monetary policy decision during the upcoming Asia-Pacific session. Announcement will be made on Wednesday at 3:00 am BST. No change to level of rates is expected as inflation remains too high.

What are market expecting?

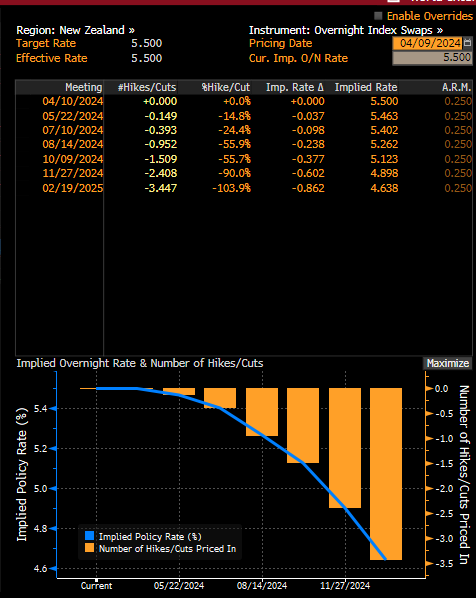

RBNZ is expected to keep rates unchanged, with the Official Cash Rate (OCR) staying at 5.50% for the sixth meeting in a row. All economists surveyed by Bloomberg expect such an outcome. Moreover, money markets also price in no change in level of interest rates at tomorrow's meeting. This should not come as a surprise given that New Zealand has not published any new inflation figures since the last meeting (as it publishes only quarterly data), and the most recent reading show CPI at 4.7% YoY, more than double RBNZ target.

Source: Bloomberg Finance LP

Investors will focus on statement

As it looks highly unlikely that RBNZ will decide on a rate cut and rates are most likely to be left unchanged, investors will focus on guidance. This may be scarce as there will be no new economic forecasts. Forecasts released by the central bank in February suggested beginning of the rate cut cycle next year, in February 2025. Market were pricing in October as the most probable outcome but those expectations became more dovish over the past month or so, and now August meeting is seen as the timing for the first rate cut. Investors will look for any hints whether RBNZ became more confident about hitting inflation target. Nevertheless, such a hint may not be offered given that no new inflation data was offered since last meeting.

A look at NZDUSD

There is a high chance that tomorrow's RBNZ rate decision will be a non event and we won't see any bigger move on NZD market. Should RBNZ statement turned out to be slightly more dovish than the previous one, NZD may pull back a bit.

Taking a look at NZDUSD chart at D1 interval, we can see that the pair is approaching an interesting technical area. An ongoing upward correction pushing the pair closer to the 0.6100 area, where previous price reactions, a 50-session moving average and a downward trendline can be found. A break above this area would make the outlook more bullish. However, should the pair test it, but fail to break above and pull back later on, it would confirm the downtrend. A dovish RBNZ statement could be a trigger for such a reversal from an important technical resistance. Nevertheless, this is not the base case scenario for the upcoming meeting.

Source: xStation5