Wheat prices stabilizing at $615 per bushel ahead of tomorrow COT report

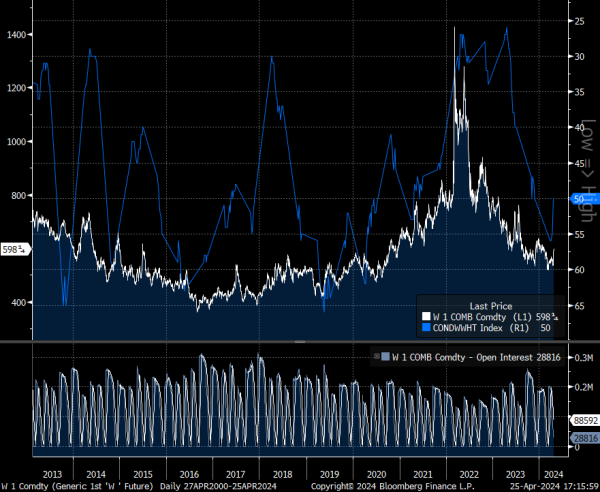

Chicago wheat futures on CBOT are still traded in the $615 per bushel zone amid concerns about lack of raining in US and Russia wheat growing areas and the latter country’s Black Sea-region. Last Commitment of Traders (CoT) reporting to CFTC (at 19 April, data for 16 April 2024) showed that large speculators had a very big, short on wheat. Tomorrow, CoT data will show how this situation has changed from 16 to 23 April, as traders expect some large-speculators to be pressured by higher crop prices and will have to cover short positions, which may lead to even higher prices. At the same time weather forecasts for Kansas, Montana, North Dakota show that the rainings may be higher in May than in April, and often above 30-years average (especially after 8th May).

Expected quality of excellent and very-high quality crops falls from 55% to 50%. Source: Bloomberg Finance LP

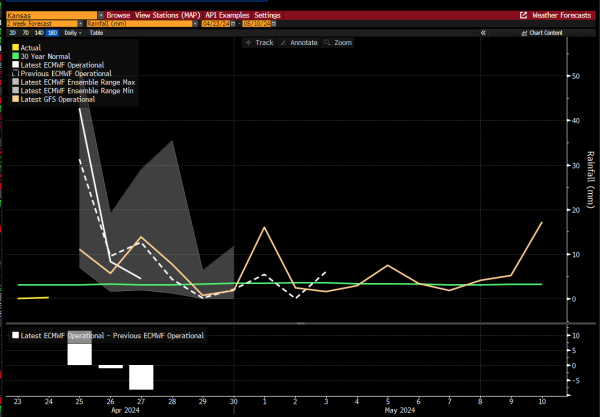

The raining level in May may be more favorable to wheat in the most important states producing wheat. Above we can see data for Kansas. Źródło: Bloomberg

The raining level in May may be more favorable to wheat in the most important states producing wheat. Above we can see data for Kansas. Źródło: Bloomberg

WHEAT (M30)

WHEAT rallied almost 12% since local lows after last rollover. The strongest support is now in the SMA50 line and as long as the price is above this zone, the basic near-term trend may signal positive momentum to higer prices.

Source: xStation5

Source: xStation5