Will the US GDP report surprise the markets?

The key US report is scheduled to be released at 1:30 PM BST 💡

Today at 01:30 PM BST, preliminary GDP data from the US for Q1 2024 will be published. The consensus points to an average annualized growth of 2.6% compared to the final reading of 3.4% in the previous quarter. Although a decrease in growth dynamics is expected, the values are still higher than historical averages.

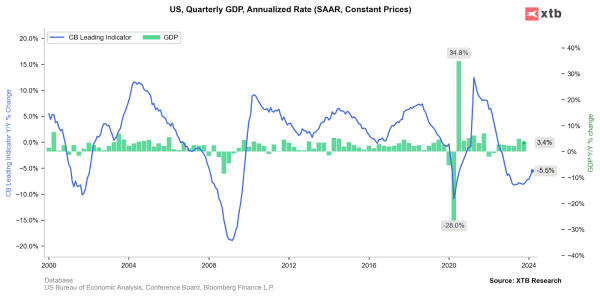

The annualized GDP growth rate has remained high in recent quarters despite a decline in the leading indicator from the Conference Board. Historically, a decline in this indicator correlated with worse quarters for the US economy, but so far, the situation remains exceptional. This is partly due to the loose monetary policy post-COVID pandemic, when consumer demand and cash in the market were record high.

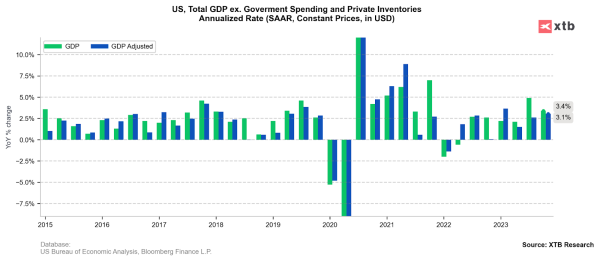

GDP growth in recent quarters has been largely driven by consumer and government spending. The situation in the first quarter of the current year has not changed significantly. Source: Bloomberg Financial LP

Highlights:

- According to analysts' estimates, consumer spending grew by about 3.0% in Q1 2023 and had a strong impact on GDP growth in the past quarter. This sector, particularly spending on services, continues to be a strong growth driver, supported by increased labor supply and good wage data.

- The manufacturing sector is performing significantly worse than the service sector, confirmed by the latest PMI data and the durable goods report. Therefore, business investment is likely not to contribute significantly to GDP growth in the last quarter. Company investments are hindered by the ongoing high level of interest rates.

- Expectations indicate that government spending will be the second largest factor contributing to GDP growth. A rebound is evident in monthly employment data. In local governments, employment increased by 3.4% on an annual basis, the most since 2021. During the same period, state administration wages rose by a similar value.

In recent quarters, US GDP excluding government expenditures has often been lower, indicating a large contribution from this segment.

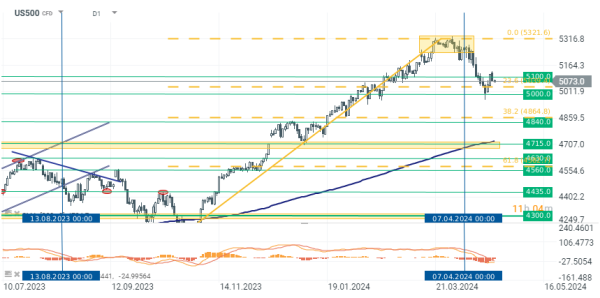

US500 (D1 interval)

SP500 futures are trading without major changes before the opening of the cash session. The key support zone to be maintained by bulls is the 5000 point level, which has recently been defended. Nevertheless, the GDP report is not likely to have a significant impact on the markets. Recent strong macroeconomic data and bankers' comments have led to a tightening of expectations for the first interest rate cuts this year. Therefore, the GDP report should not significantly affect these expectations, assuming that the publication does not deviate significantly from the consensus.

Source: xStation

US2000 (D1 interval)

The benchmark US2000, representing the behavior of the Russell 2000 index, is currently testing the 2019 point zone, where historically peaks from August 2022, February 2023, and July 2023 have occurred. Breaking this zone could encourage buyers to test the resistance zone marked by the 50-day exponential moving average (blue curve). In case of stopping the rises, we can assume the zone of the 100-day exponential (purple curve) and the 200-day exponential (golden curve) as the main support level.

Source: xStation