WTI drops below $72.50 in spite of inventory draw

WTI crude oil (OIL.WTI) is falling below the important support level at $72.50 per barrel today, testing recent local lows from early August. At the same time, it is clearly dipping below the levels from June. This is happening despite optimistic sentiment in the markets and after declines in U.S. inventories. Interestingly, Israel continues its offensive in Palestine. Hamas is currently not agreeing to the U.S. proposals for a ceasefire and accuses the U.S. of buying time for Israel. Nonetheless, the potential for an agreement being signed also puts pressure on oil.

Source: xStation5

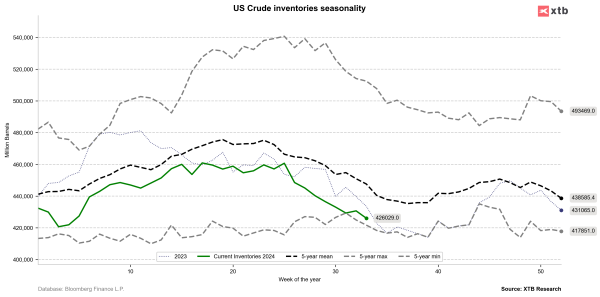

Inventories are returning to declines and are already close to a five-year low. A local bottom in inventories could be possible in a few weeks. Source: Bloomberg Finance LP, XTB

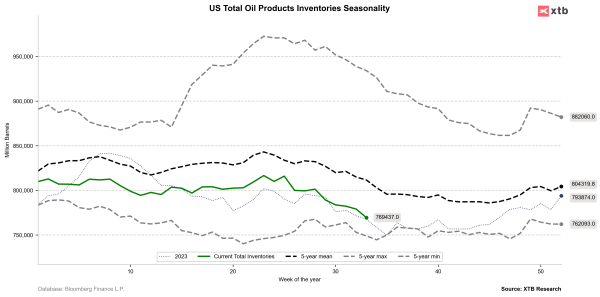

Petroleum product inventories have fallen to around last year's levels. Despite this, prices are lower than they were a year ago. Source: Bloomberg Finance LP, XTB

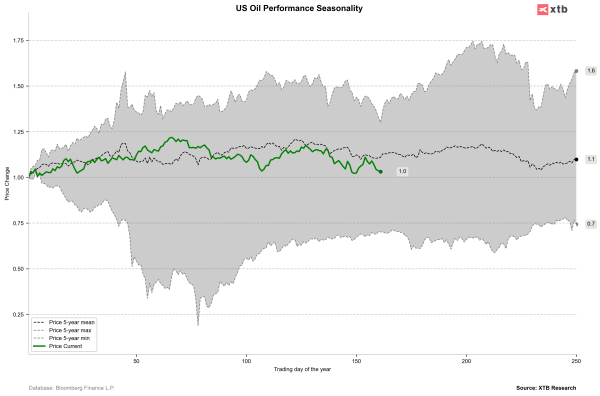

The price of crude oil is currently similar to what it was at the beginning of this year. However, seasonality suggests a possible slight recovery in the coming weeks. It is worth remembering that there is backwardation in the oil market, so each rollover results in a nominally lower price. Source: Bloomberg Finance LP, XTB