Yen volatility remains high as equities appear calmer – Volatility Watch

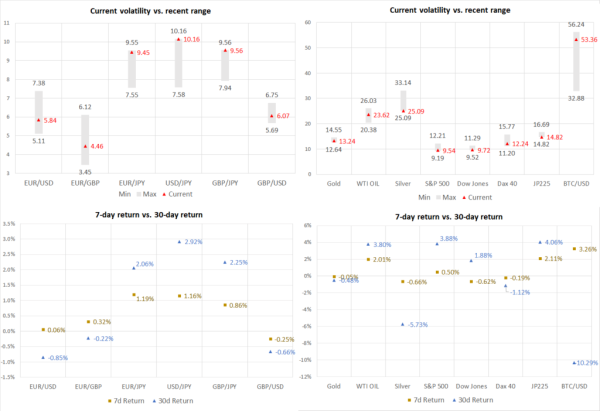

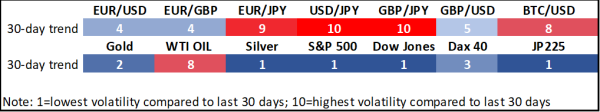

Euro/dollar volatility jumps after French elections

Volatility in commodities eases, apart from oil

Stock indices’ volatility falls ahead of key data releases

Euro/dollar volatility has eased over the past week as the market is breathing slightly easier following Sunday’s French elections result. On the flip side, volatility in yen crosses remains extremely high as market participants continue to provoke the BoJ by pushing dollar/yen above the level that led to the end-April intervention.

In the meantime, volatility in both gold and silver has eased considerably despite the lingering geopolitical risks. Having said that, oil price volatility jumped higher, thus signaling a much higher possibility for stronger movements ahead, as Iran is preparing for the second round of its presidential elections.

On the contrary, stock indices' volatility has dropped aggressively even as the market appears to be preparing for an action-packed week with the US non-farm payroll report coming on Friday, which could determine the Fed’s stance at the July 31 gathering.

Finally, volatility in the king of cryptos remains very high, despite the strong weekly gains, as Bitcoin is still trying to find its footing following the June correction.