Morning Wrap (30.09.2024)

XTB Daily Analysis

- Friday's session on global financial markets ended sharply higher for European indices. In the case of Wall Street, the gains were not so uniform, with mainly small market capitalization companies rising. The technology Nasdaq closed the day's trading nearly 0.39% lower.

- The new week begins with a continuation of bullish sentiment in China on the back of a broad plan to cut interest rates and implement additional measures to help stimulate the economy. The indices there are extending their robust gains, with Shanghai indexes, among others, trading 7% higher today alone.

- The People's Bank of China announced over the weekend that it will instruct banks to lower mortgage rates for existing home loans before October 31. In addition, the three cities of Guangzhou, Shanghai and Shenzhen have announced home buying facilities.

- The mood is extremely positive at the moment, but it should be remembered that all this is happening before the National Day holiday. As a result, Chinese markets will have a week-long break starting tomorrow. Domestic markets will not resume trading until October 8.

- As a counterbalance to the good sentiment in China, the Caixin PMI data came out at 49.3 (previously 50.4) for manufacturing and 50.3 (previously 51.6) for the services reading.

- The USDJPY pair starts Monday's trading with an extension of declines. According to the macro data, August retail sales came in at 2.8% y/y (2.3% was expected), while industrial production fell 3.3% m/m (-0.9% was expected) over the same period.

- Nearly 5% declines are currently being seen on the Nikkei, after Ishiba's win in the vote for the role of Japan's new prime minister was confirmed after hours on Friday. Ishiba supports normalizing Japan's monetary policy, which translates into higher interest rates. He is also more open to tighter fiscal policy, including increased taxes on corporations and income earned in the capital market.

- The most important macro event of the day, which is likely to raise market volatility during today's trading, is CPI data from Germany (headline reading at 1:00 p.m. BST; however, a spike in volatility may occur at 09:00 a.m. BST, when data from individual states will be known). A Chicago PMI data reading and speeches by Powell and Lagarde are also scheduled in the afternoon, but it is unclear at this point whether the bankers are going to refer to the current monetary situation.

- On the geopolitical side, attention turns to the Middle East, where reports suggest that Israeli forces are focusing on the northern front and preparing for a ground invasion of Lebanon.

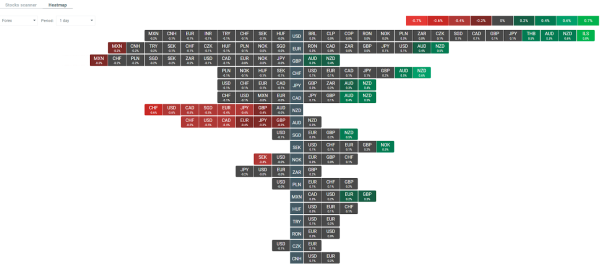

- Antipodean currencies are currently doing best in the FX market. Declines are seen primarily in the Swiss franc and the US dollar. Natural gas is currently losing nearly 2% on an intraday basis. In contrast, we are seeing slight increases in the oil and gold markets.

- Bitcoin halts the bullish rally on Monday morning and retreats 2% to the $64,600 level.

Current volatility on individual currency pairs. Source: xStation